The Seventh Week of Trading 2022.

All eyes turned to the Elephant in the room, with the Russia and Ukraine narrative dominating the global headlines. Investors and traders are now trading along with the latest headlines coming from the US Secretary of State, Anthony Blinken and not those coming from the US Federal Reserve Chairman, Jerome Powell.

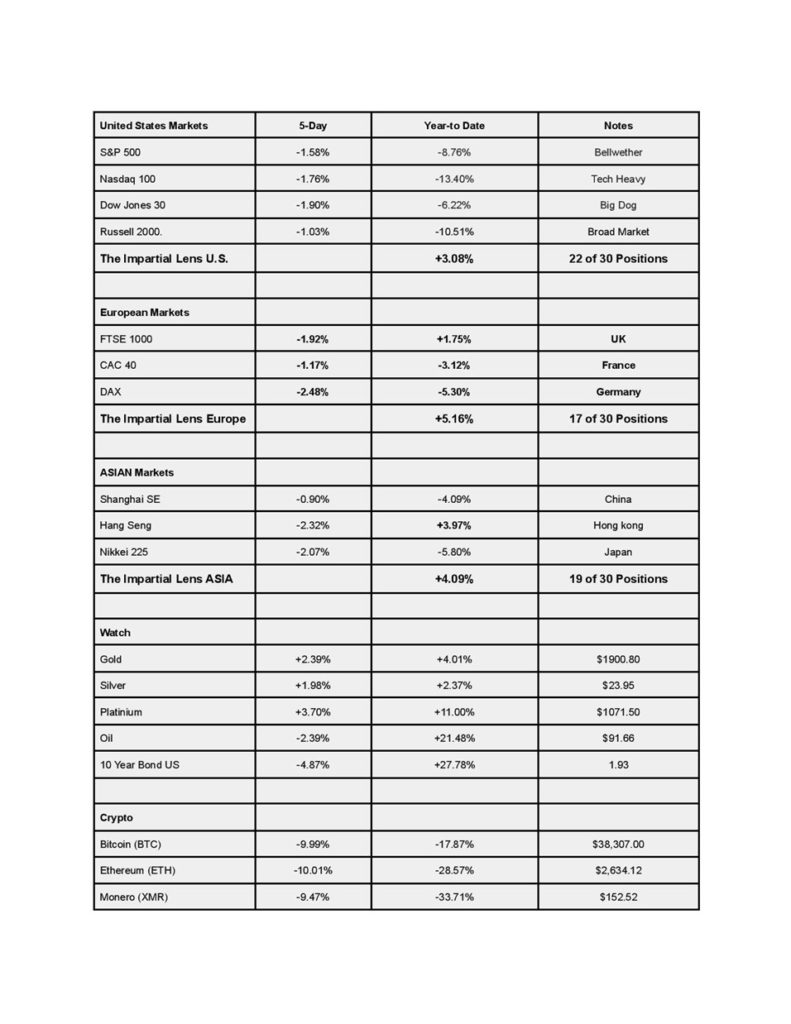

The S&P 500 closed out the week with a -1.58% loss, down -8.76% year-to-date. The Down Jones closed down +1.98%, down -6.22% YTD, while the Russell was negative for the week -1.03%, down -10.51% YTD. The Nasdaq 100 was down -1.76% and -13.40% YTD.

Cryptocurrencies mimicked the stock market’s action at the beginning of the week, collapsed Tuesday, and faded lower for the rest of the week, with Bitcoin finishing up 9.99% for the week and down -17.87% YTD.

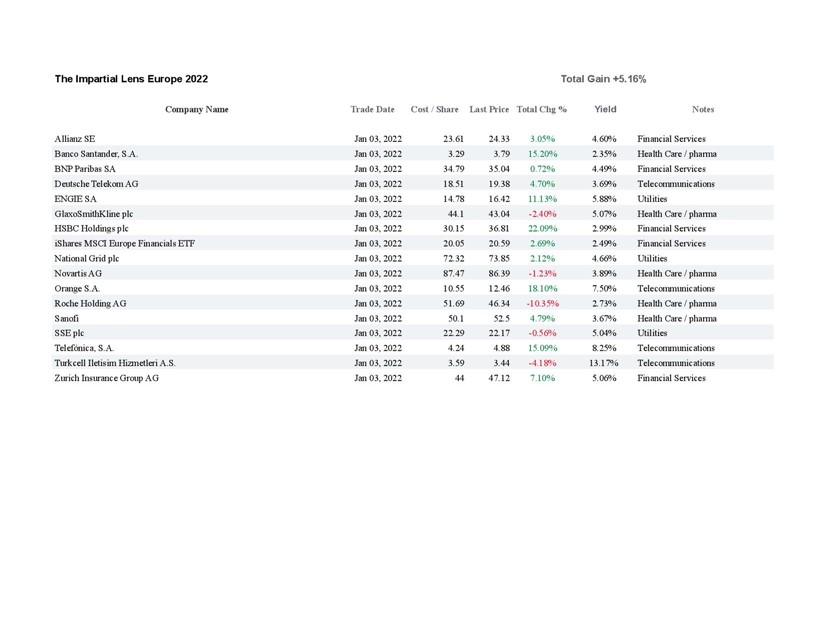

European markets did not fare any better than their US counterparts, the UK’s FTSE, down -1.92 for the week, hanging on to its positive +1.75% YTD. The French CAC was down -1.17% for the week, while the German Dax was down -2.48%. Both are negative for the year, -3.12% and -5.30%.

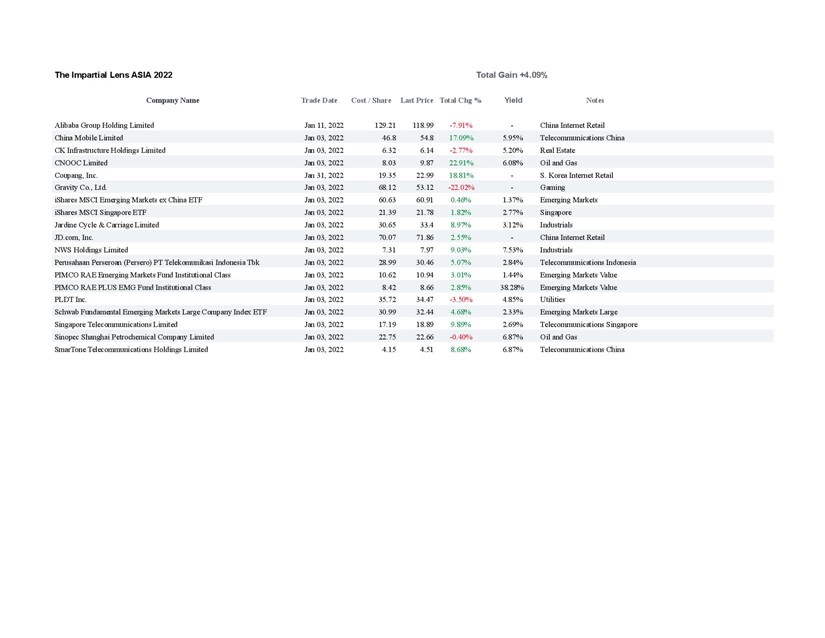

Asian markets finished mixed, with China’s Shanghai down -0.90% for the week. With the Hang Seng finishing down -2.32%, Hong Kong suffered, while Japan’s Nikkei finished negative -2.07% for the week.

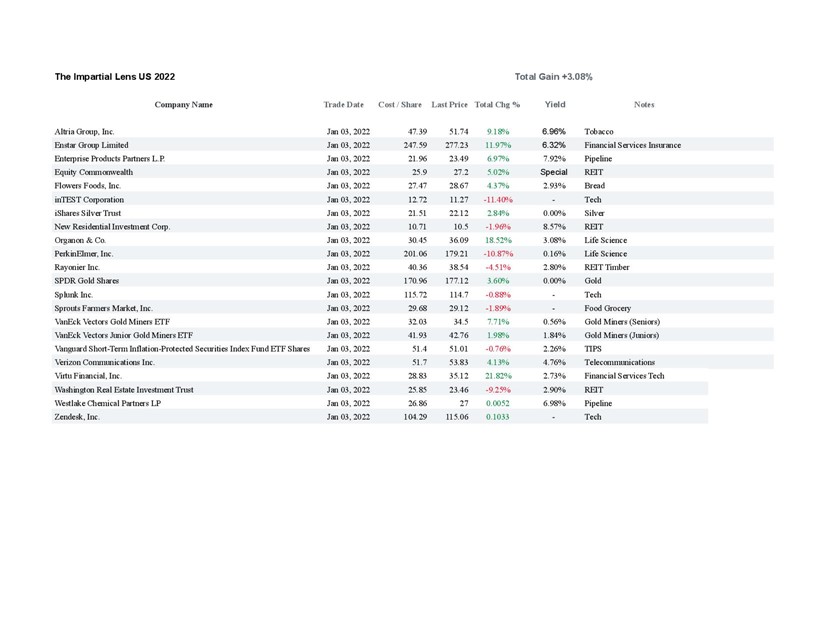

The Impartial Lens model portfolios held their own against all markets. See below.

The Drums of War bang loudly via Anthony Blinken. Putin has heard the same tune many times over the last several years.

Who is holding the aces and how will it affect the markets?

Global Markets

Model Portfolio

The information contained here is for educational purposes only. Do not use this information as personal financial advice.