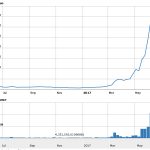

An update on Ether (graph of Ether above) and Bitcoin holdings 14 June 2017: Consider taking small profits as the price keeps rising and get your initial capital back so that you can enjoy a free-ride on the way up. Consider buying more or for the first time on Pullbacks. You should have an exit strategy in place to protect and bank your gains. One suggestion is to place a mental stop loss or a certain % trailing stop-loss under the ever-evolving price.

An update on Ether (graph of Ether above) and Bitcoin holdings 14 June 2017: Consider taking small profits as the price keeps rising and get your initial capital back so that you can enjoy a free-ride on the way up. Consider buying more or for the first time on Pullbacks. You should have an exit strategy in place to protect and bank your gains. One suggestion is to place a mental stop loss or a certain % trailing stop-loss under the ever-evolving price.

The following is the original article from August 2016.

Bitcoin went mainstream in 2013 in the aftermath of the Cyprus bank bail-in where the powers that be confiscated up to 40% of Bank of Cyprus accounts and 60 % at Laiki for accounts with deposits north of 100k Euro. Bitcoin’s price exploded 8,256% within 11 months when the price jumped from $13 to $1,157 per coin. Nice for some. Today Bitcoin is now accepted by 100,00 + merchants including Amazon, Expedia, Microsoft, Dell and a number of airlines.

The beauty of digital currencies and gold is the fact that they are good hedges against fiat currency devaluation. Let’s face it, money can be anything. Salt, rice, cows, gold, silver, barley, tea leaves, they’ve all had their day in the sun. With fiat currency made from the paper being the current mode in usage, I should mention that’s it backed by NOTHING. The $U.S. Dollar has been described as an ‘I owe you’ type of agreement with the Euro a ‘Who owes Who what?’ currency. At the end of the day, maintaining confidence in our paper currency backed by nothing would seem to be supremely important in keeping this show on the road a bit longer. Considering that the root of the word confidence is ‘con’, I wouldn’t blame the paranoid among us from getting a little worked up. What would happen in the case of a worldwide derivative crisis with the 6 ‘too big to fail’ banks exposed to 28 times the size of their total assets and running into approximately $278 trillion dollars? Warren Buffet described the situation a few months back as a ‘timebomb’. Well never mind a trivial timebomb or ‘weapons of mass destruction’ which he described the derivative risk as, maybe it will just be the simple fall of the Petrodollar, a good old-fashioned credit crisis in China (their turn for some medicine), never mind the existence of negative interest rates in 20+ countries or even the War on Cash where large denominated notes are now the scourge of the bankers.

If any of the above should happen, it may be worth your while hedging your risk especially if all your loot is sitting in the bank (it’s actually been loaned out due to our fractional reserve system but hey that’s another story). The U.S. Dollar has lost 95% of its value in the past 100 years. As a result of recent Quantitative Easing Programmes a la money printing, each dollar is diluted a little further. Gold and digital currencies are not controlled by a central bank thankfully and therefore can’t be diluted.

Digital currencies are basically highly secure online databases. There is a newcomer to the digital currency space which has caught the attention of major financial institutions and tech giants such as IBM, Microsoft, and Samsung who all have set up partnerships with the new kid on the block. The next potential Bitcoin is called Ether and its creator, Vitalik Buterin, a 22-year-old Canadian is sitting on a potential digital goldmine. It’s currently priced around the $11 price after a recent run-up of 400% since it’s release. A recent hack has caused the price to drop 25% from its recent high. This can be seen as a golden buying opportunity. Bitcoin was also hacked before it’s price surged 400% back in 2010.

The reason the tech giants and financial institutions are so interested in Ether is that besides being so fast, it’s decentralized ie. the records are tracked on thousands of computers around the world. This technology has the potential to savagely reduce transaction costs and consign wire transfers to the dustbin of history. Bitcoin is essentially a payment system whereas Ether has expanded the idea to include any type of transaction once the proper code is written and therefore potentially excluding middleman from large transactions such as lawyers in the case of mortgages for example. A sensible play would be to have exposure to both Bitcoin and Ether.

One consideration is to get in on the act before 22 August when the first-ever Digital Currency ETF may be included on the BATS Exchange. The venture capitalists behind the ETF are the Winklevoss twins, who successfully sued Mark Zuckerberg to the tune of $65 million for stealing their idea ConnectU before he went on to create Facebook. Their ETF is currently awaiting SEC approval to be listed. If the ETF gains approval, investors will be able to invest in digital currencies without having to open a digital wallet. The War on Cash along with the central banks implementing negative interest rates make a little exposure to these digital currencies a decent hedge against currency risk.