What Happens Next

Economists describe inflation as “too many dollars chasing too few goods.” When you have too many dollars chasing the same thing, the chase will drive the price up. Things will become more expensive.

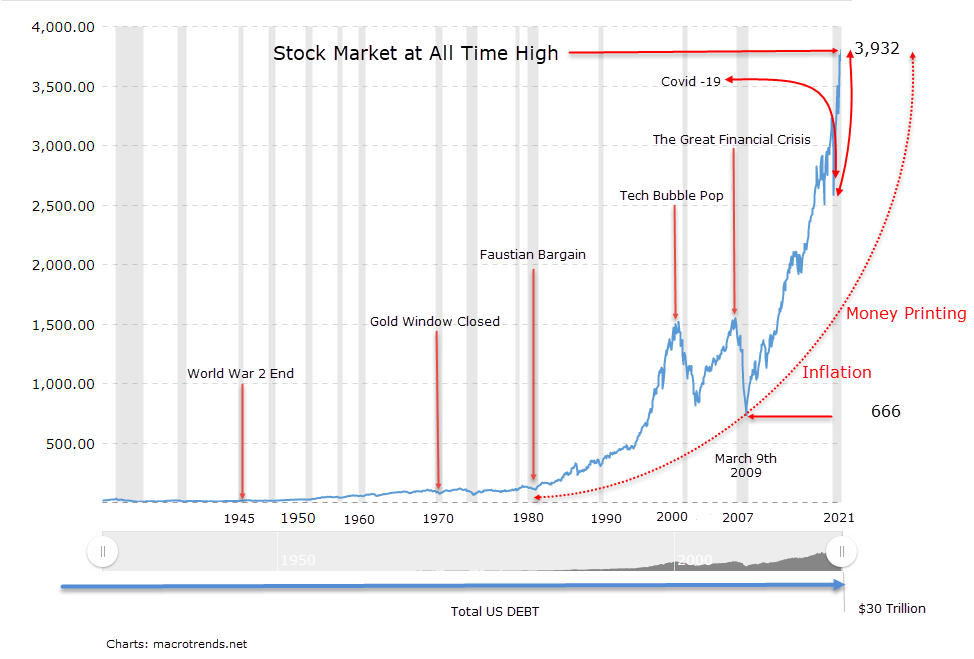

If you look below, you will notice the stock market chart from the end of World War 2 1945 to 2021. You can see quite clearly the Tech Bubble of the early 2000 and the subsequent bust, and you can also see the Housing Bubble followed by the Great Financial Crisis of 2007 and 2009.

To the right of the chart, you can see the tremendous inflationary money-printing experiment of 2009-2021, literally bursting off the chart, with the stock markets S&P 500 going vertical to today’s all-time highs of 3,932.

At the same time, we have an economy that has stalled, unemployment rising, people paid to stay at home, businesses and individuals struggling, or on government life support.

How is it possible that the markets are screaming for a record after record high when the real economy, people, business, goods, and services have all suffered tremendously?

US Stock Market 1945 to 2021

A Faustian Bargain

A Faustian Bargain is a pact with the Devil, whereby an individual or a people trade something moral or spiritual, such as their souls, for some worldly or material benefit, such as knowledge, power, or riches.

However, the benefits are temporary, perhaps decades-long, but eventually, you must repay the Devil with your soul.

In the wake of the destruction of World War 2, the U.S. emerged as the strongest country in the World. It had amassed most of the World’s Gold, was the most industrially advanced nation, and was the least damaged during the War.

More importantly, the U.S. inherited the privilege of becoming the World Reserve Currency, a benefit previously held by the badly damaged and shrinking Empire of Great Britain.

The U.S. dollar became the undisputed Heavy Weight Currency of the World, and from now on, it would make the rules. The majority of global trade would now be conducted in the mighty U.S. Dollar… backed by Gold.

The privilege allowed the U.S. to become very rich for a while. However, by the late1960’s, the U.S. had squandered its treasure, having spent most of its Gold.

So, in 1971 the U.S. declared an act of bankruptcy and closed the Gold window. The U.S. Dollar became fiat or fake…backed by nothing, except the full faith and credit of the U.S. government.

The World went into shock, and chaos erupted. War and violence dominated the more impoverished regions of the World, while stagflation and recessions dominated the Western World.

By the late 1970s, inflation in the U.S. was out of control. The Federal Reserve and the Bond Vigilantes drove up interest rates to tame the rampant inflation. The economy was dying, and the U.S. needed a solution; the U.S. would need to give the World a good reason to hold the U.S. Dollar, a reason other than Gold.

The U.S. was on its knees and ready to make a bargain to regain its dominance. A deal with the Devil, a Faustian Bargain would do. The deal would allow:

The U.S. to defend its title as World Reserve Currency through a combination, oil Market control, financial shenanigans, War, intimidation, sanctions, embargoes, bullying, and most importantly, the ability to expand debt.

The Devil would just wait until the debt could expand no more.

The Debt Feast

The inflation of the 1970’s was crushed by raising interest rates, raising the prime rate in the U.S. to the dizzying height of 21.5% in 1981, but the economy was on its knees

Through a combination of Central Bank policy, government approval, deregulation of the financial system, accomplices at the Treasury, shoddy oversight, credit and debt once again began to flow.

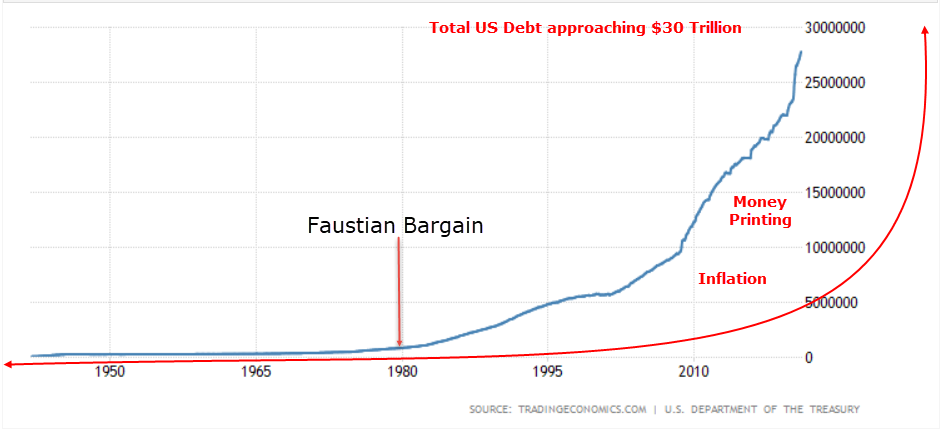

The monetary base began to explode, and debt began to grow faster than the real economy.

The bond market hit its bottom in 1981, and the stock market hit its bottom in 1982. The Devil didn’t lie, good times were here again, and we wouldn’t have to worry about the debt or the payback for decades.

Well, decades have passed, and we didn’t have to look back until now. The powers that be, the Federal Reserve, and the Treasury have bailed out the system by issuing more and more debt.

As you can see from the chart above, we’ve had two major shocks in the stock market since 1982: the Tech Bubble and the Great Financial Crisis. However, when you look at the details, they’ve had to continuously bail out the system since 1980, and the debt has erupted. We are rapidly approaching $30T, with the forecast for Trillions more.

Total US Debt

The powers that be have had to intervene in every crisis we’ve had since the 1980s. And since the Great Financial Crisis of 2007, we now realize that we can never ever stop printing money. It is inflate or die…

Bailouts Since 1980

Covid -19 Crisis 2020 – 21

Great Financial Crisis 2007

Tech Bubble 2000

The LTCM Crisis 1998

The Asian Crisis 1997

The Tequila Crisis 1994

The S&L Crisis 1990

Black Monday 1987

Give the Devil his Due

Funnily enough, the bottom of the last major stock market crash was on Mar 9, 2009, at 666, the Devil number. It’s been inflate or die ever since.

In the aftermath of the Great Financial Crisis, the economy had collapsed. The first domino to fall in the Great Financial Crisis was the housing market; the panic that ensued exposed the game for what it really is. A debt-fueled Ponzi scheme, supported by the powers that be.

They have been bailing out Wall Street since the 1980s, and now because of Covid-19 Crisis, another Crisis, they currently have to bail out you and me on Main Street, as well as their interests on Wall Street.

They’ve provided a tsunami of debt to flow into the economy, and it has rushed into the financial markets. The bond markets, the stock markets, the housing markets, the corporate debt markets, the crypto-currency markets, and so on, they’ve all exploded to the upside.

Investors and traders have surfed this wave of free money backed by debt and driven the markets to all-time highs. The above charts show the tsunami of asset price inflation rises from an Ocean of Debt.

We are in awe of the money printing and have been humbled by the retail investor. Their lack of experience and formal education about the stock markets has served them well; they have made themselves small fortunes, fair play. We hope that they have learned enough and that they know when to book profits.

Debt/liquidity fueled stock markets and free money backed by debt given to individuals. You combine that with Covid-19 boredom, blissful ignorance, momentum, social media, and you have a speculative frenzy.

The tremendous appetite for risk leads us to conclude that investor taste buds have been removed or they are completely unaware that a threat exists.

Give the Devil his due; he has drawn us all into the frenzy and set us up to take away our souls and the soul of the U.S… the mighty Dollar.