The Tenth Week of Trading 2022.

All the major indices in the US finished down for the week. Investors and governments alike all seem to be caught in the headlights of the geopolitical juggernaut. News, scenarios, falsehoods, fake news, propaganda, and outright lies are dominating the headlines.

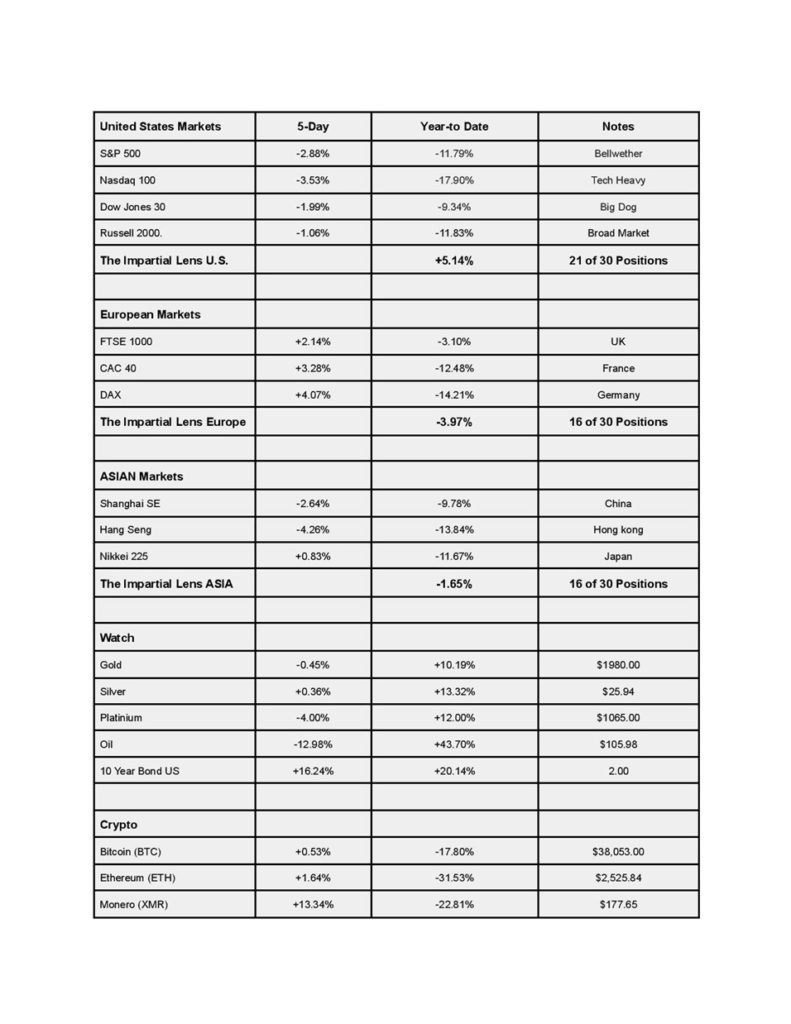

The Dow Jones Industrial lost -1.99% for the week, -9.34% YTD. The S&P 500 index was down -2.88% for the week, down -11.79% YTD. The tech-heavy Nasdaq collapsed a further -3.53% for the week. -17.90% YTD, while the Russell 2000 small-cap index lost -1.06% for the week, down -11.83% YTD. Bitcoin had another wild week. Bitcoin managed to crawl across the line at +0.53%, down -17.80% YTD, Ethereum faired better at +1.64% for the week, although still down -31.53% YTD. Monero had another stellar week, up +13.34%, but down -22.81% YTD.

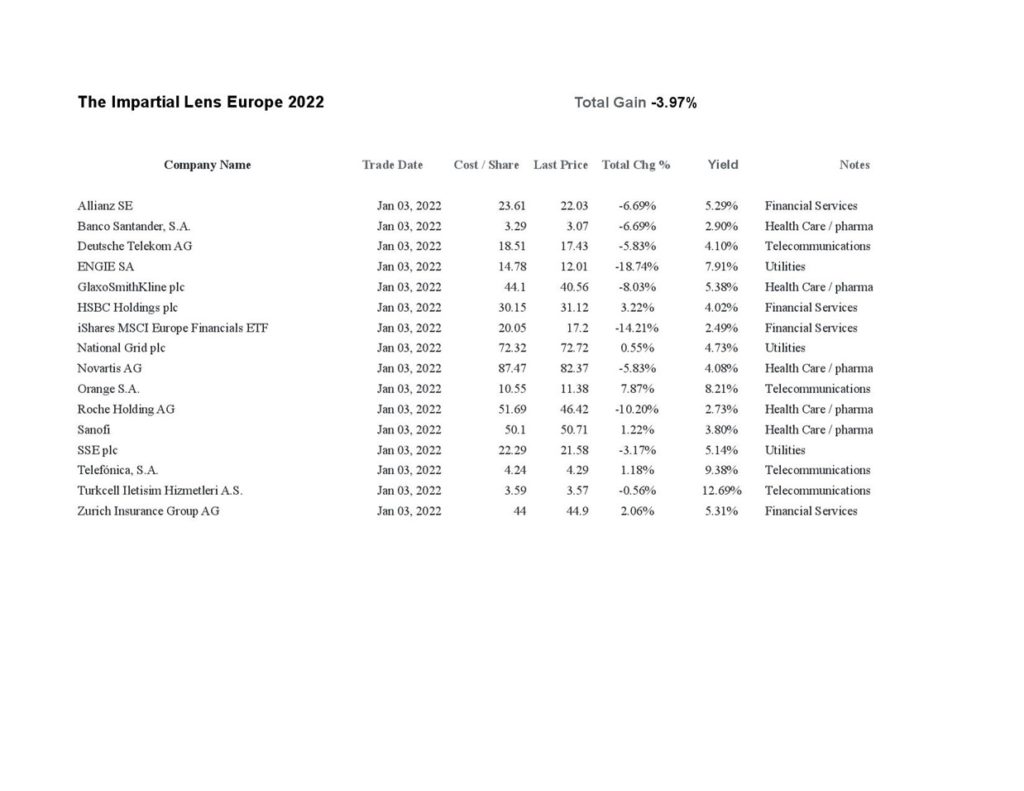

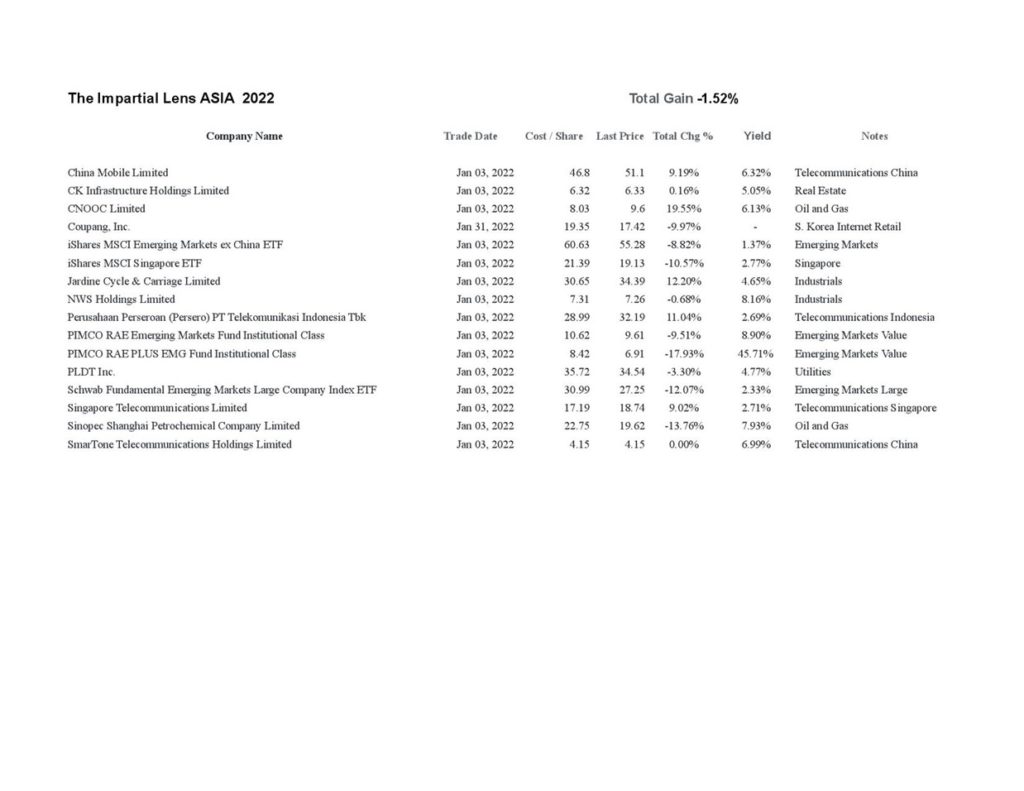

European markets managed to have a favorable week, stopping the hemorrhaging of losses from last week. While the Asian markets had a very tough week, only the Japanese Nikkei managed to finish positive +0.83%, while Hing Kong and mainland China both finished in the red, -4.26% and -2.64% respectively.

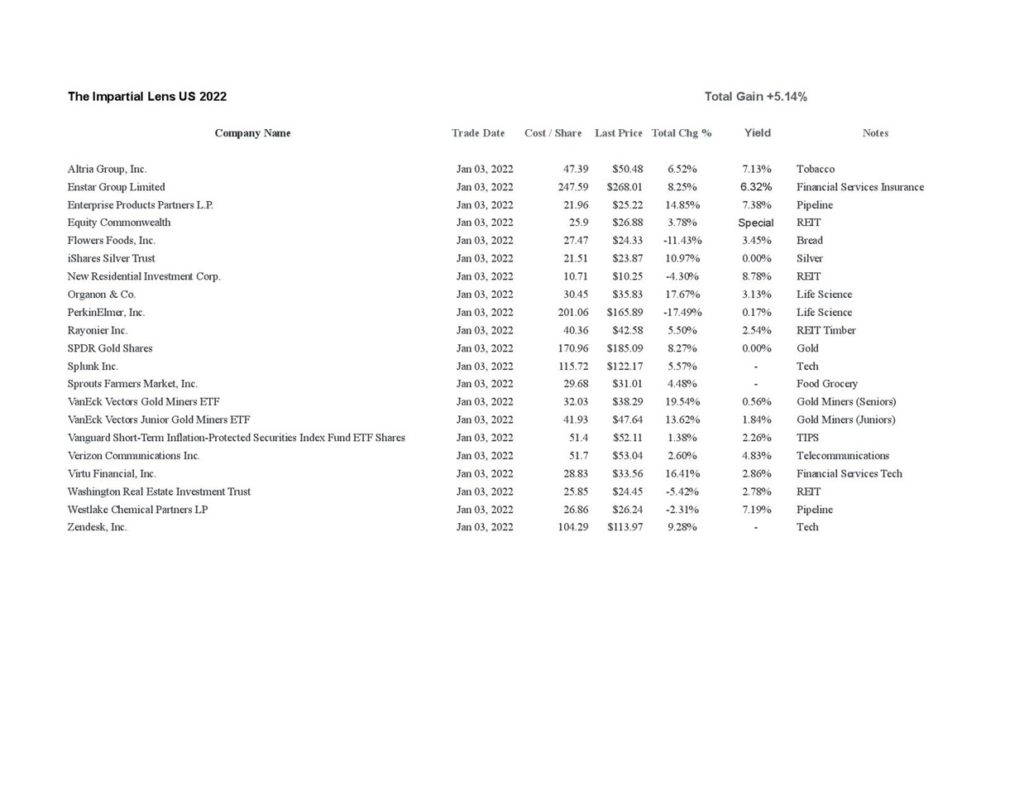

The Impartial Lens model portfolios managed to keep treading water for the week avoiding the strong downdraft gripping most world markets. We stopped out of inTest Corporation in the US, BNP Paribas SA in Europe, Alibaba Group Holdings, and JD. Com in Asia.

Although we see major headwinds in front of us going forward, we do see a bounce in equities along with a pullback in Commodities in the coming weeks. It will give us an opportunity to refine our strategy as we head to the end of the quarter.

Global Markets

Model Portfolio

The information contained here is for educational purposes only. Do not use this information as personal financial advice.