The Eleventh Week of Trading 2022.

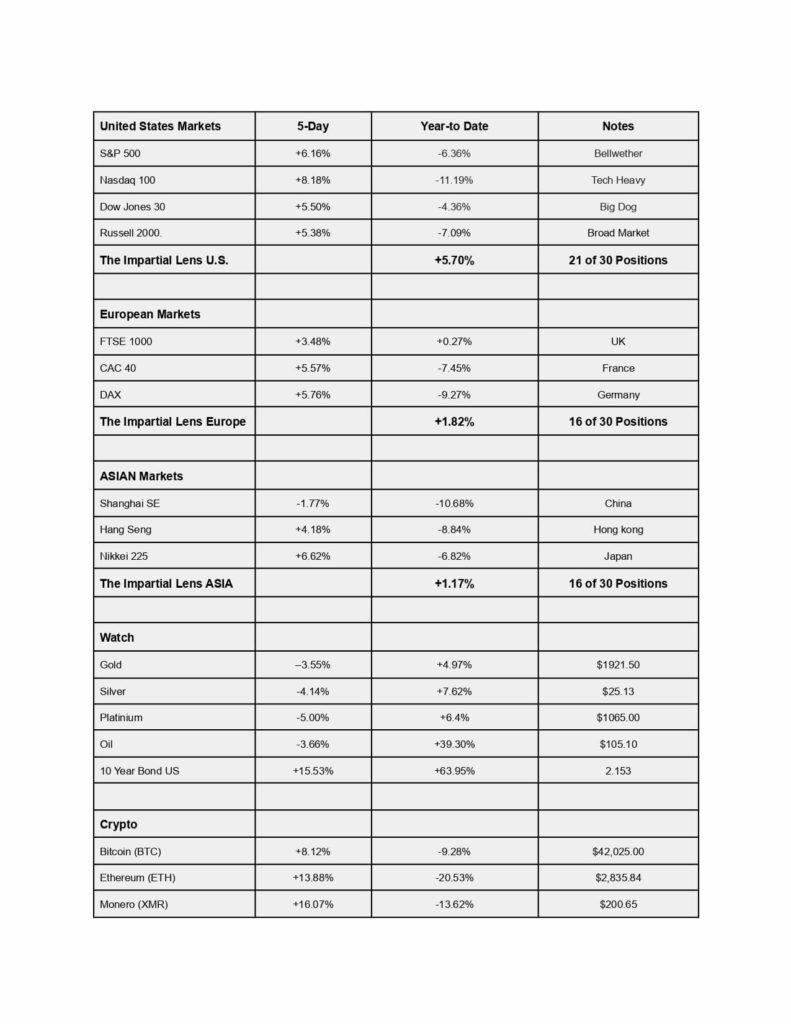

As we mentioned last week, stocks were poised to have a rally, “we do see a bounce in equities and a pullback in Commodities.” The markets had the best week since the 2020 election; all indices squeezed higher. The Nasdaq soared over 8% last week, and the rest of the majors also exploded higher.

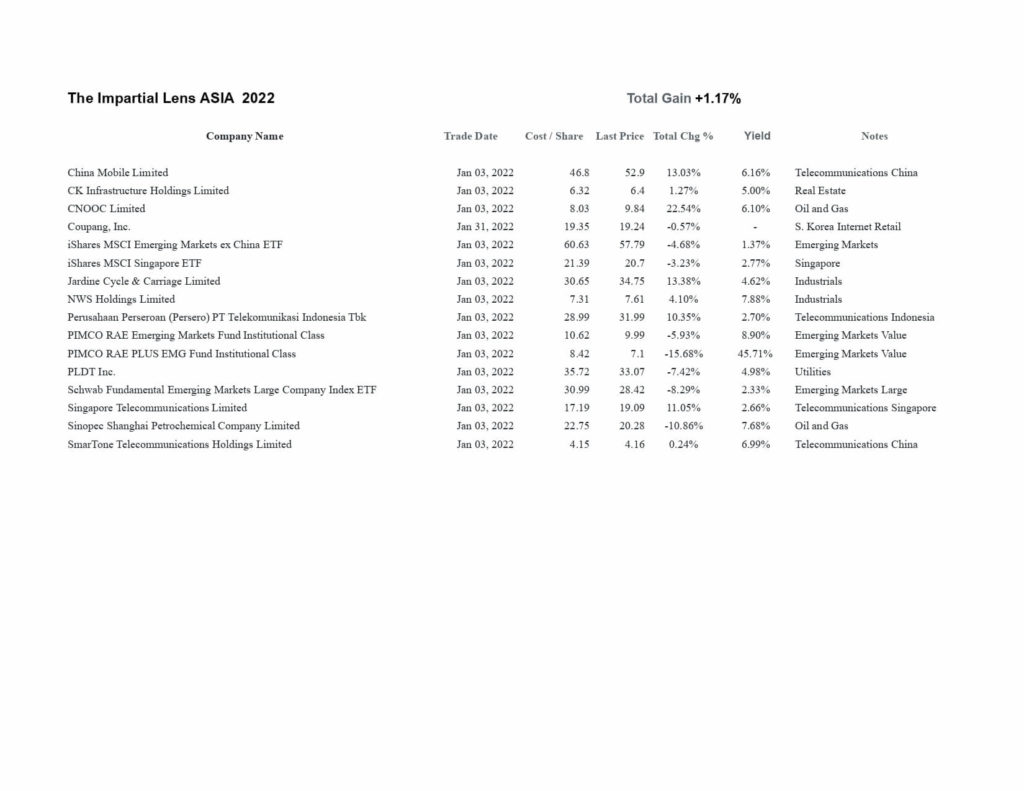

All global markets managed powerful rallies. European, Asian, followed the US markets higher. Despite the enormous Chinese tech rally, the only laggard was the Shanghai stock exchange. Bitcoin did not miss out on the performance, with all significant cryptocurrencies finishing well in the green for the week. See Below.

As we mentioned with the stock rally, we had the corresponding decline in commodities.

We could easily see the markets correct in the short term, only to regain their strength and reconnect with their moving averages.

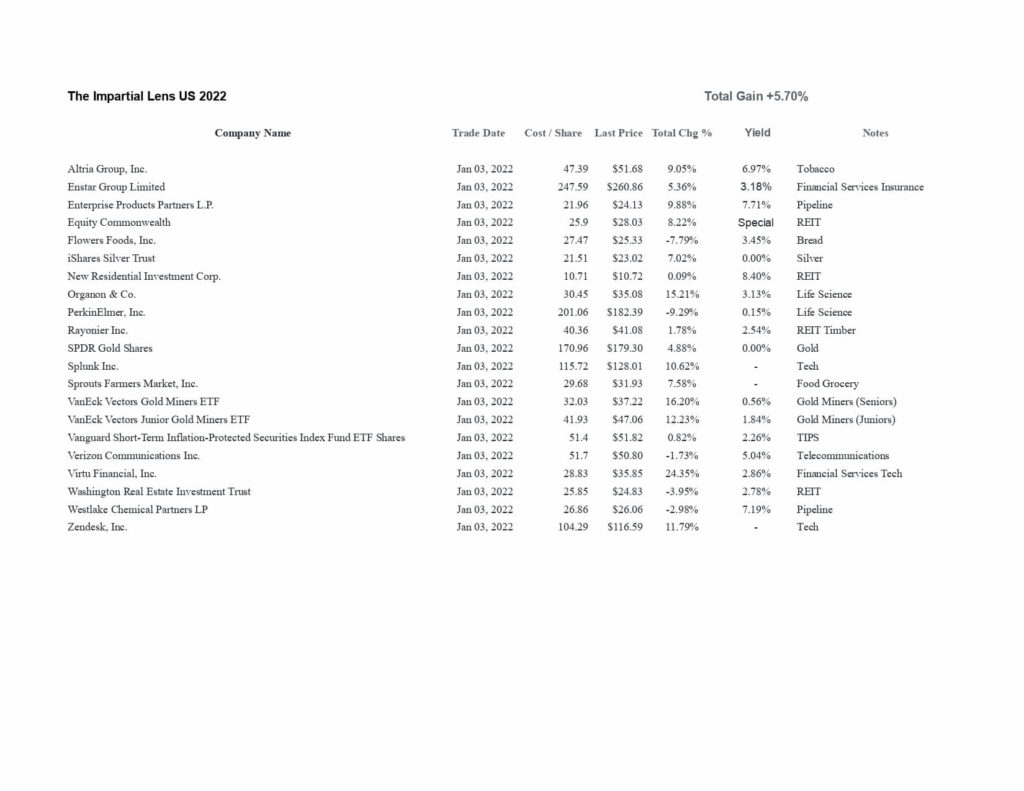

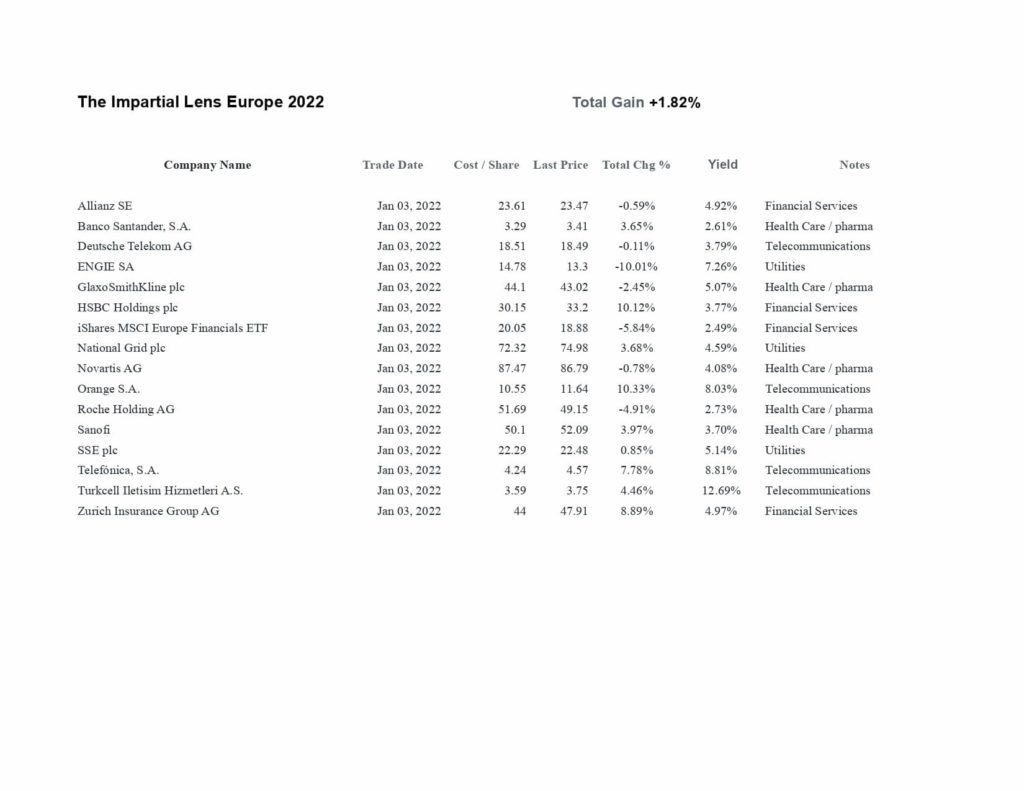

The Impartial lens Model portfolios enjoyed the relief rally along with most participants. The model portfolios are all positive YTD, while the US, European, and Asian markets are all negative YTD. See Below.

The big question on market participants’ minds for the week ahead is, do we sell into strength if we hold a weak hand and perhaps readjust to include more exposure to commodities if they weaken further?

Global Markets

Model Portfolio

The information contained here is for educational purposes only. Do not use this information as personal financial advice.