The 13th Week of Trading 2022.

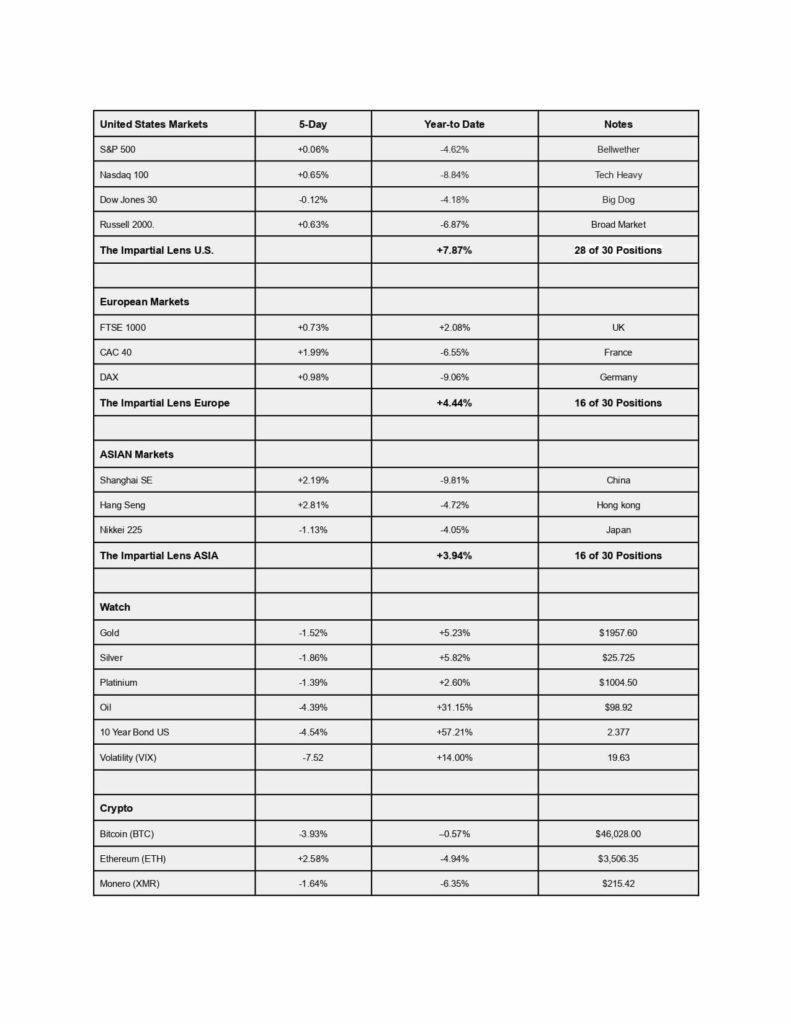

The wall of resistance that we mentioned last week for U.S. markets held firm. We had a push early in the week to breach the wall, but all of U.S. indices ended flat for the week. The European markets were mixed, with the FTSE leading the pack, +1.06%. France and Germany finished negative. In Asia, Hong Kong and China were down, while Japan had an exceptional +4.93% for the week. Cryptocurrencies were in the red, Bitcoin, Ethereum, and Monero all posted negative price action.

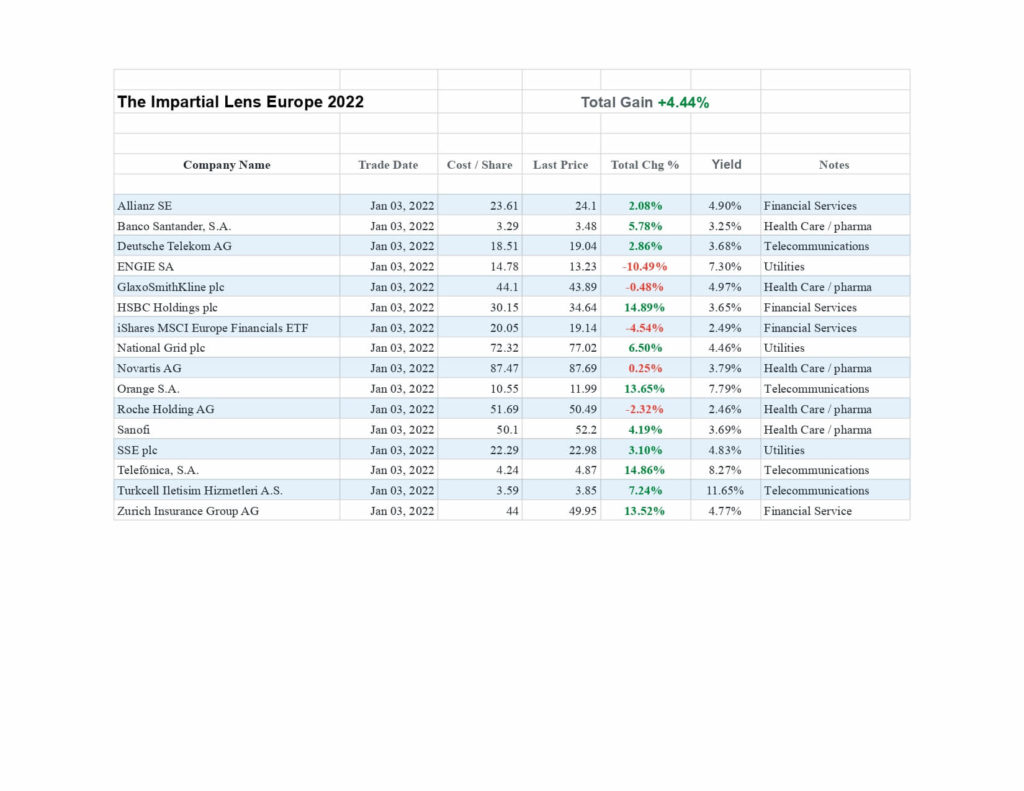

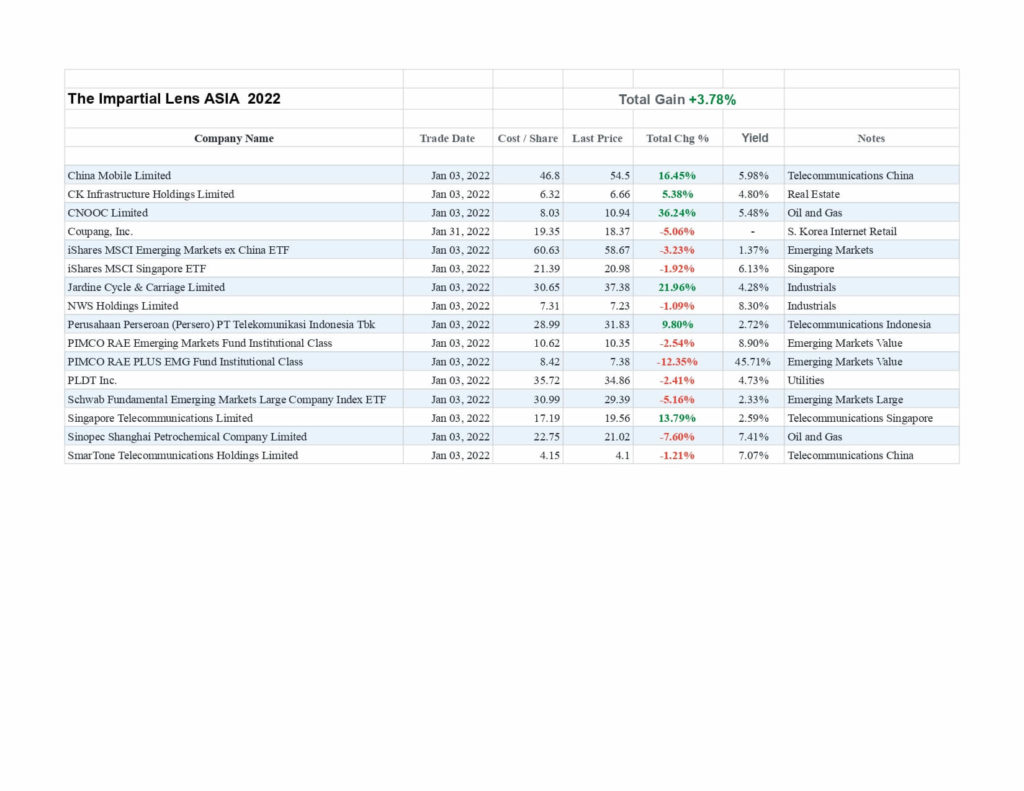

The model portfolios had a fair first quarter. Our U.S., European, and Asian portfolios lead all major indices.

We added a contrarian position to our U.S. portfolio ie. iShares 20+ Year US Treasury Bond ETF. We did not find an entry on any shorts, but like we said last week, “we will tighten up our stops”, and “look to add shorts”. We have cash streaming in with our dividends (the primary reason we put these portfolios together).

We still have some powder dry. We will short the market if the opportunity is presented to us. We have also added Volatility to our market indicators, something that all investors should watch. Currently, it is lower than before Russia carried out its “special operations”..

Global Markets

Model Portfolio

The information contained here is for educational purposes only. Do not use this information as personal financial advice.