Fourth Week of Trading 2022

The fourth week of trading in 2022 was something to behold. At the beginning of trading on Monday, Investors fell through a trap door. Markets plummeted at the open and dropped straight down, only to slam on the breaks in the late morning and recover in the late afternoon. Monday’s trading set the tone for the week’s trading, with all markets succumbing to volatility, panic buying, and manic selling, giving rise to wild swings in the markets.

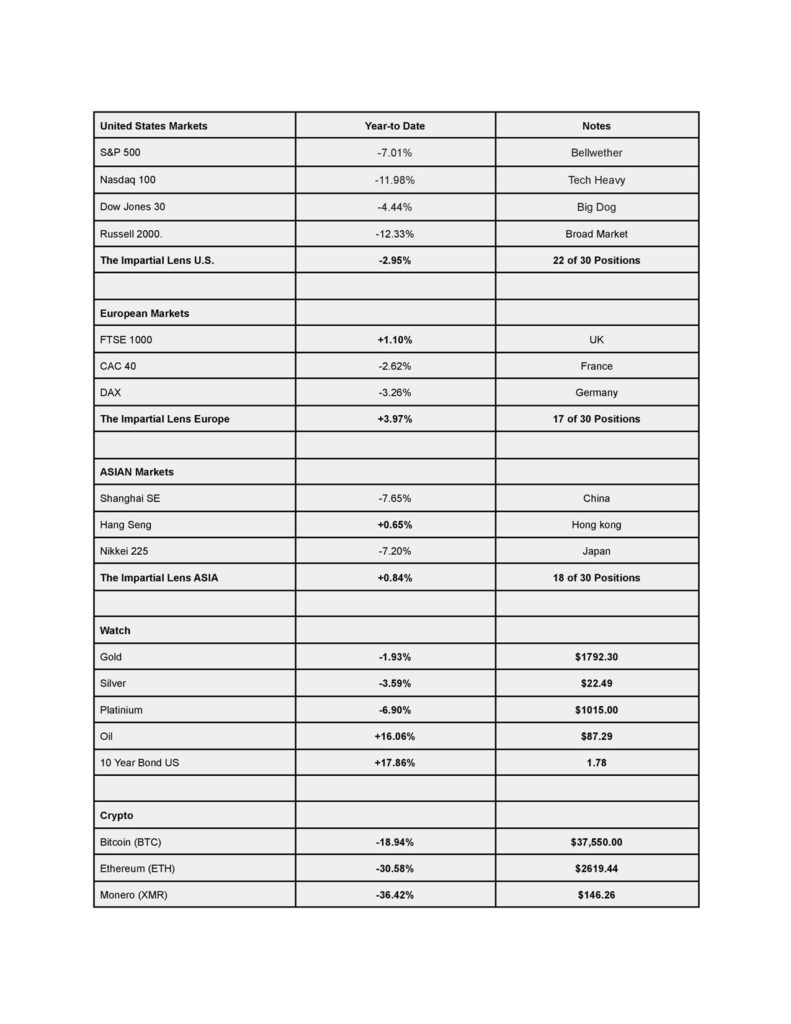

Despite the wild swings up and down, the week ended with very little change. The S&P 500, the Dow Jones, and the Nasdaq finished slightly positive for the week, and Bitcoin led the way with a 2.1% gain, while the Russel 2000 finished down -1.8%.

The S&P 500 has suffered its worst start to a new year since 1939. While, the tech-heavy Nasdaq is down for the 5th straight week, suffering its most significant losing streak since 2012.

It was also the worst month for US Treasuries since Nov 2016, with the short-end exploding over 40bps higher in yield and the long-end up around 20bps. The yield curve is flatter for the 4th straight month to its flattest since March 2020, indicating a recession within a year.

January was a very harsh month for cryptocurrencies, Bitcoin down -17% and Ethereum down -27%. Gold suffered minor damage, hovering around $1800.

European markets suffered less volatility than their counterparts across the pond. The UK’s FTSE closed slightly higher on the week, with the French CAC and German Dax marginally lower.

Asian markets finished lower for the week, China and Japan down, with Hong Kong suffering the worst, down -4.22%

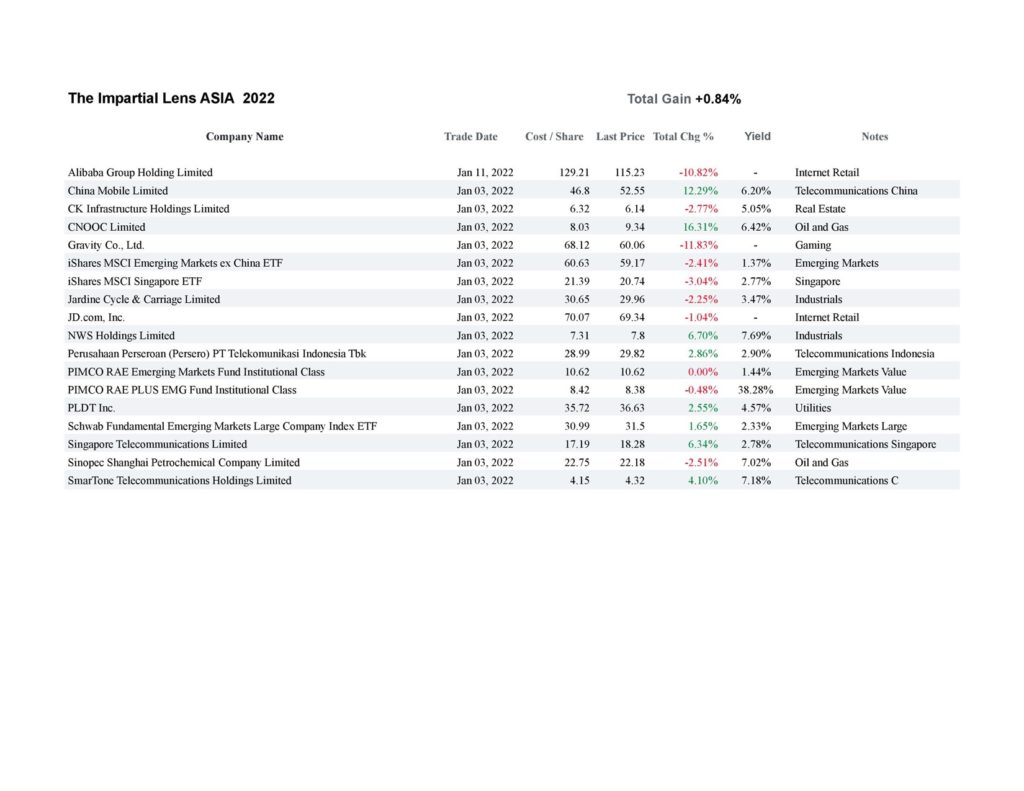

We stopped out of one of our positions in our model portfolios. Geely Automobile Holdings Limited, although we believe to be a good company, it is critical to maintain your discipline and control your risk.

The Big question on investors’ minds this coming week. Shall we sell any bounce?

Global Markets

Model Portfolios

The information contained here is for educational purposes only. Do not use this information as personal financial advice.