The Ninth Week of Trading 2022.

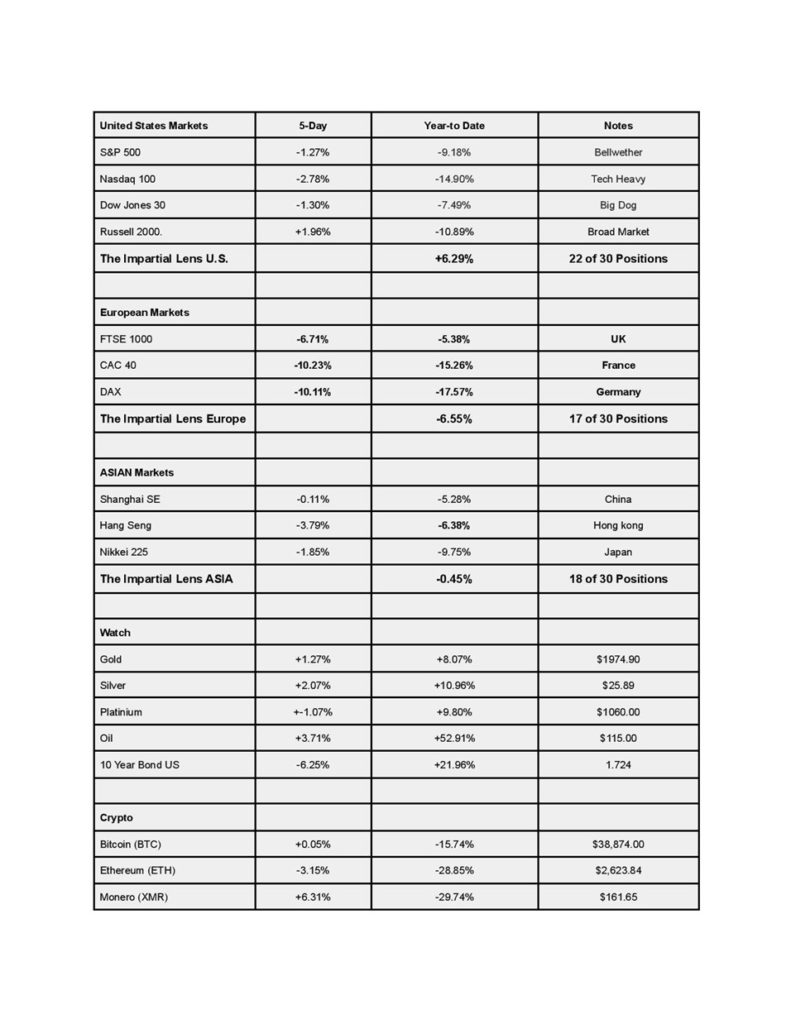

As we pointed out a couple of weeks ago, “all eyes turned to the Elephant in the room, with the Russia and Ukraine”, beginning to dominate the news cycle. That Elephant has turned rather violent and has stomped many market sectors. United States, Europe, and Asia all got crushed in the ninth week of trading, with the only bright spot being commodities, Oil, Gold, Silver, Platinum, and palladium all up for the week.

One other area of the commodities sector that has exploded higher is the soft commodities; Wheat, Corn, and Soy are all seeing supply strains that are beginning to reflect the price.

The S&P 500 closed out the week with a -1.27% loss, down -9.18% year-to-date. The Down Jones closed down -1.30%, down -7.49% YTD, while the Russell was negative for the week -1.96%, down -10.89% YTD. The Nasdaq 100 was down -2.78% and -14.90% YTD.

Cryptocurrencies had a mixed week, with Bitcoin finishing up flat +0.05% for the week and down -15.74% YTD. Ethereum -3.15% for the week, down -28.85% YTD. The only bright spot in the crypto space was Monero +6.31% for the week, -29.72% YTD

European markets got absolutely hammered for the week, the UK’s FTSE, down -6.71% for the week, down -5.38% YTD. The French CAC was down a whopping -10.23% for the week, -15.26% YTD, the German Dax was down -10.11% for the week, -17.57% YTD.

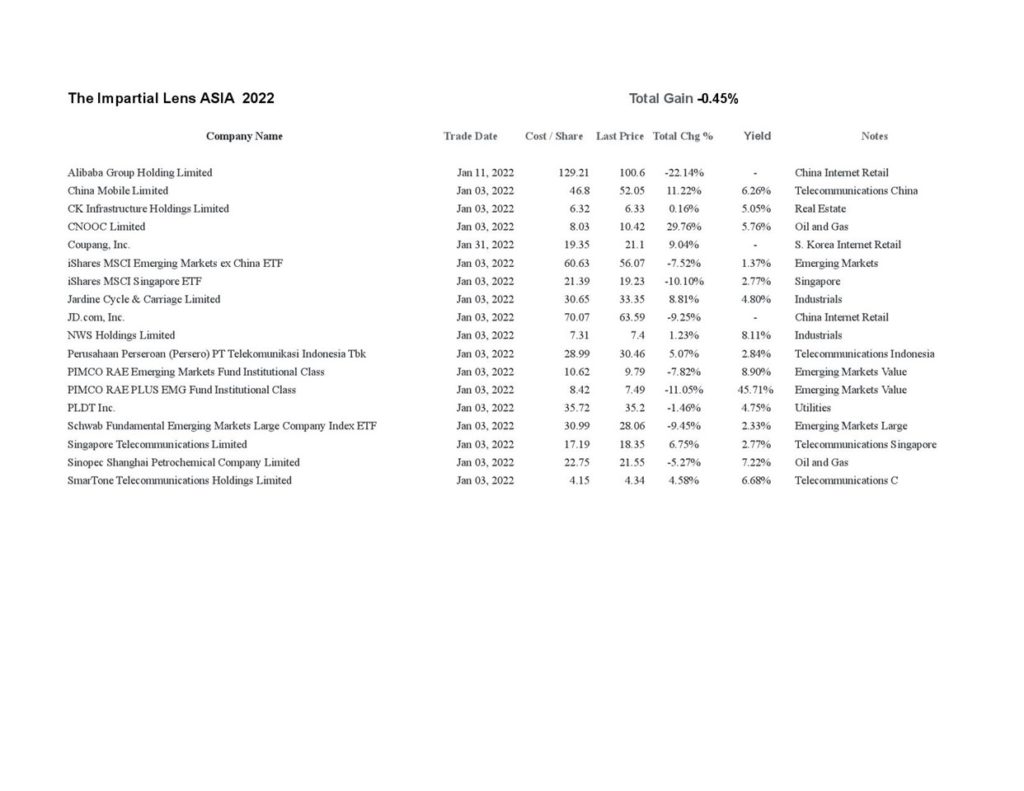

Asian markets finished mixed, with China’s Shanghai down -0.11% for the week, -5.28% YTD. Hong Kong’s Hang Seng ended down -3.79% for the week, -6.38 YTD, while Japan’s Nikkei finished negative -1.85% for the week, -9.75% YTD.

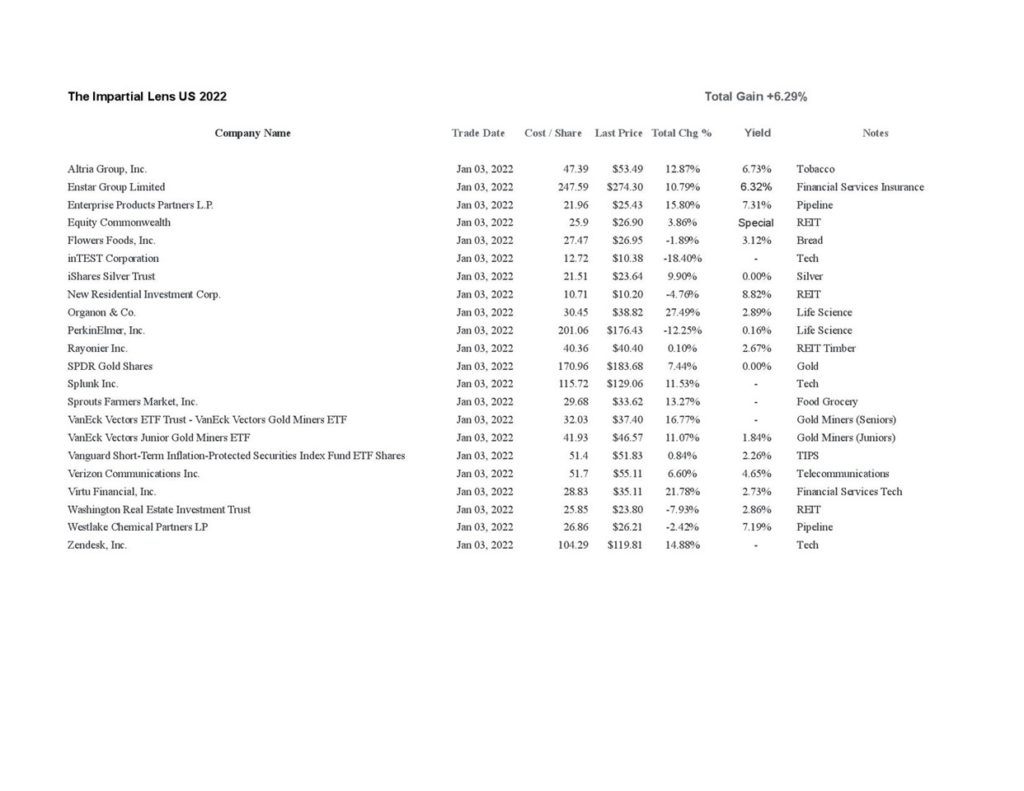

The Impartial Lens model portfolios were mixed for the week. Our US exposure is gaining slowly but surely, up YTD +6.29%

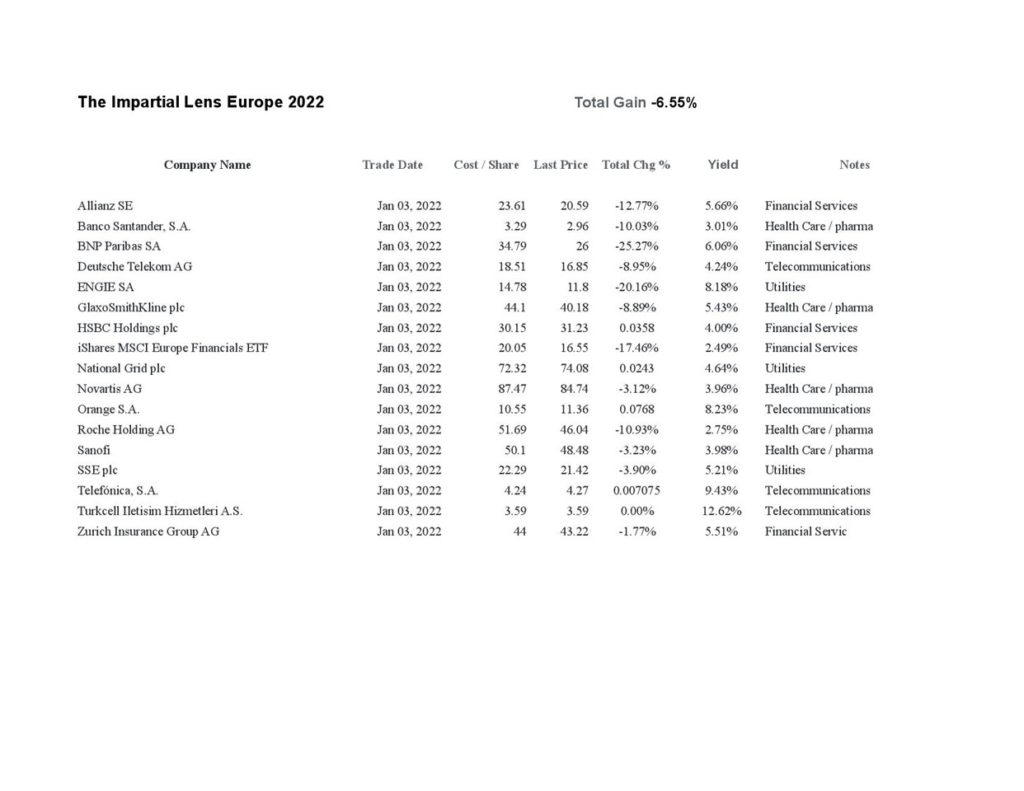

Our European exposure got hammered for the week, down -6.55% YTD. Our Asia exposure also took it hard for the week, down -0.45% YTD.

During times like these, know what you hold and why. Keep your stops tight and disciplined, and live to fight another day.

Global Markets

Model Portfolio

The information contained here is for educational purposes only. Do not use this information as personal financial advice.