Third Week of Trading 2022

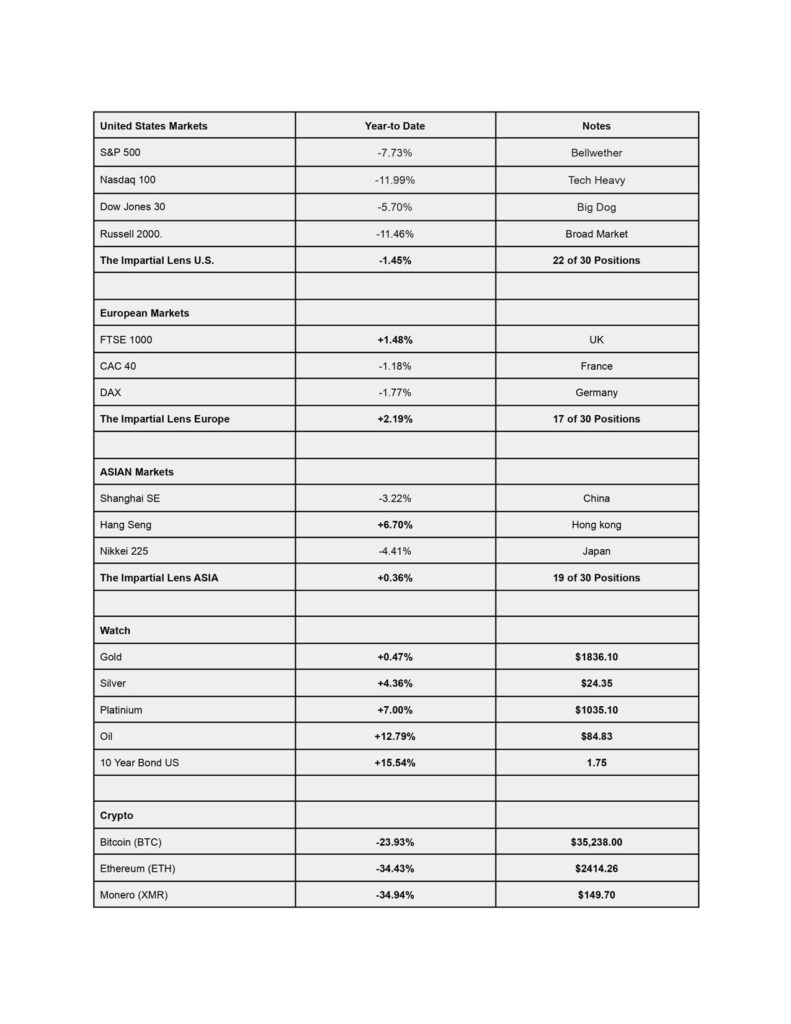

The third week of trading in 2022 saw the third straight week of losses for US Markets, with the S&P, the Nasdaq, the Russell, and the Dow all down significantly. This was the worst week for the Dow since Oct 2020, the S&P and the Nasdaq posted their biggest percentage weekly drops since March 2020, and it was the Russell 2000’s worst week since June 2020. The 5-year chart below, courtesy of Yahoo Finance, clearly highlights the sell-off in each index. The Nasdaq (IXIC), the S&P 500 (GSPC), the Dow (DJI), The Russell 2000 (RUT).

Friday saw violent interday reversals in most US markets, with benchmarks rising +2% during the session, just to reverse and finish -1% at the close. The technical damage was evident as all major indices closed below their 200 day moving averages.

European markets did not avoid the drawdown in the markets, the UK -0.65%, France, -1.04%, and Germany down -1.76% for the week.

Asian markets were a mixed bag, with China holding steady at +0.04%, Hong Kong was the only bright spot with a substantial rise of +2.39%, while Japan took it in the teeth down -2.39%

There was murder on the crypto dance floor over the past week, with Bitcoin down -21%, Ethereum down -33%, and Monero down -38%. We will add more cryptocurrencies to our watch list in the coming days. The cheaper things become, the more interested we become.

We stopped out of three of our positions in our model portfolios. Two in the US, Olo Inc., Madrigal Pharmascetical Inc., and one in Asia, Grab Holdings Limited. Although we believe they are good companies, it is critical to maintain your discipline and control your risk.

Markets look oversold in the near term and most U.S. indices have fallen below their 200 day moving averages. Market sentiment is very bearish. The majority of investors are thinking along similar lines so we think that a bounce is likely.

Global Markets

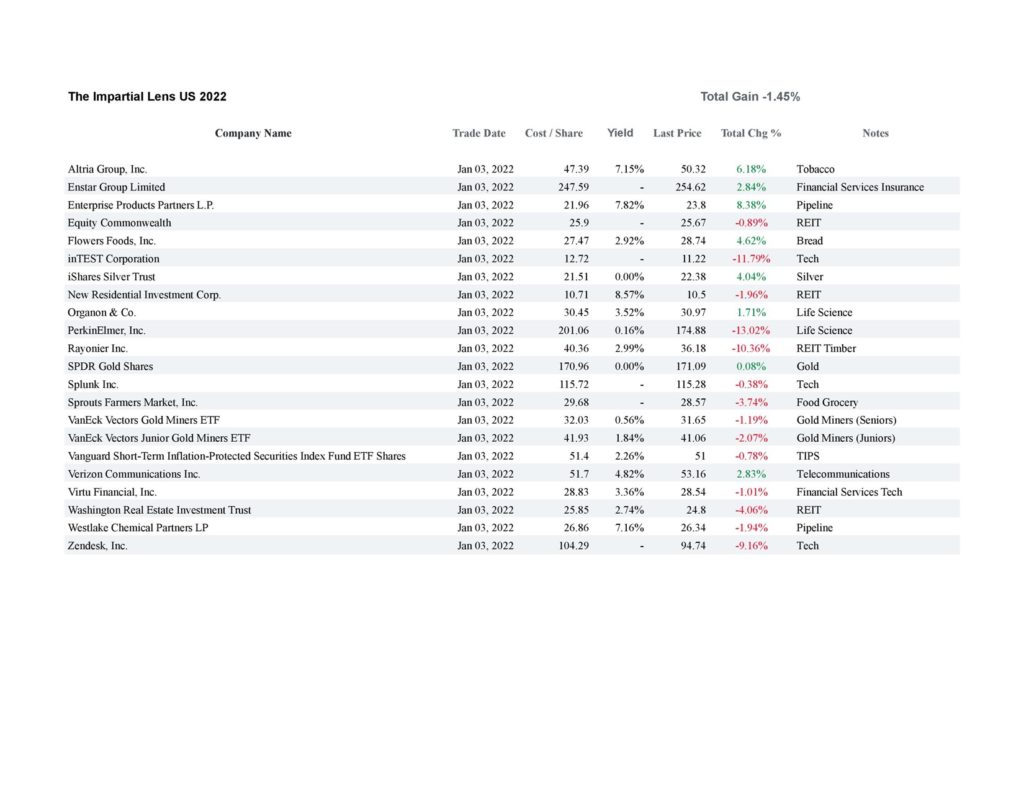

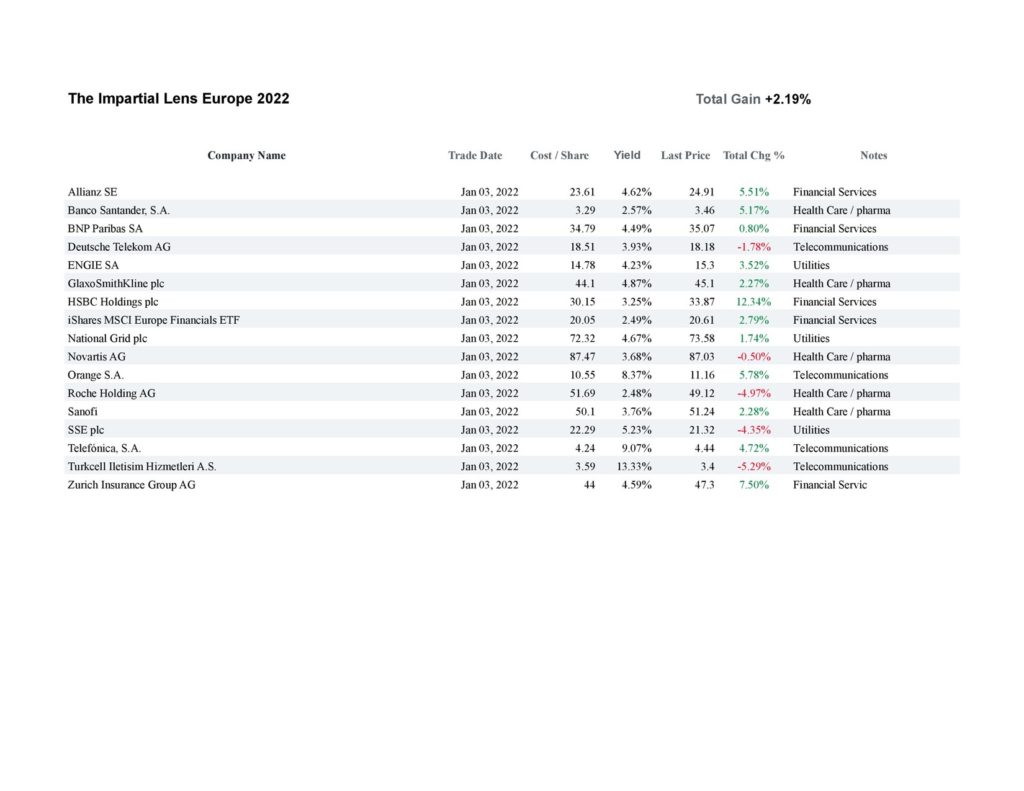

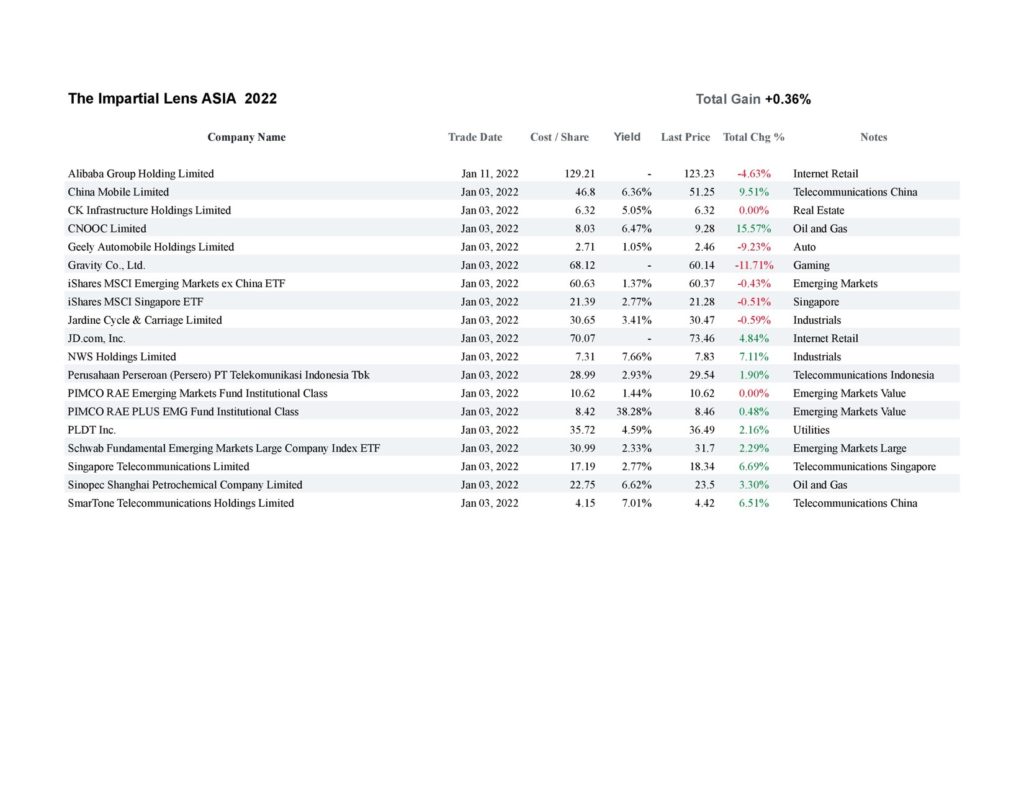

Model Portfolios