The Twelveth Week of Trading 2022.

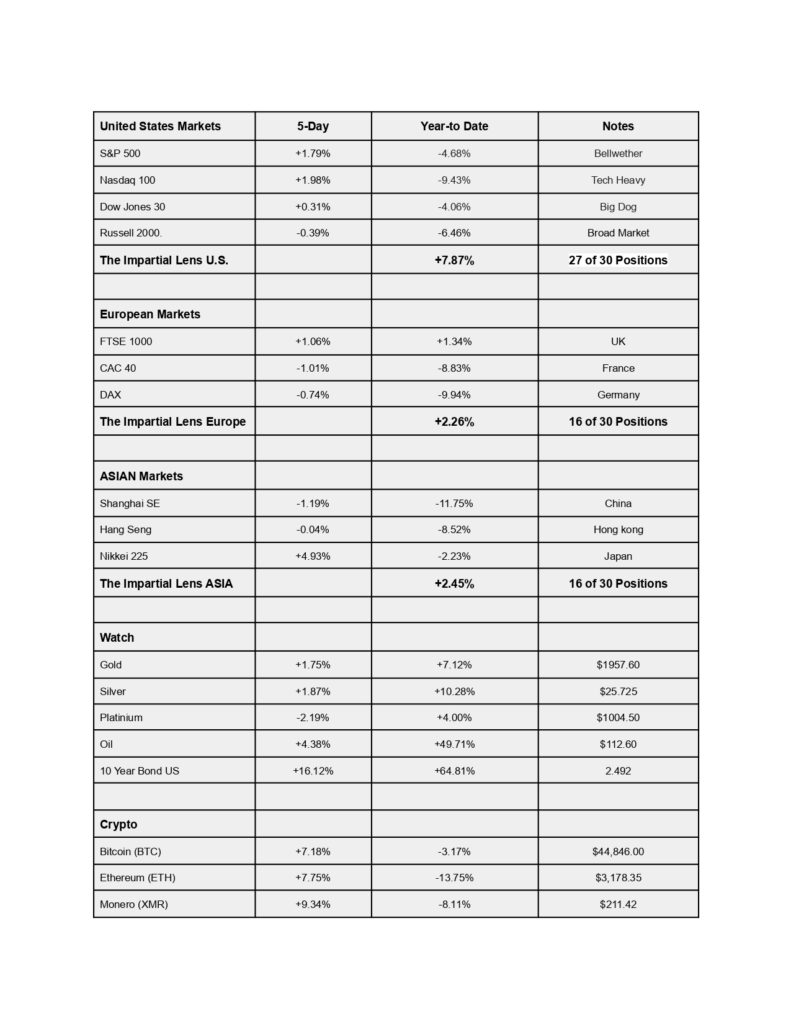

Last week’s powerful global equity rally started the week on a shaky footing; participants were nervous to see which direction the markets would move. Most markets did finish the week positively, but not convincingly so.

The squeeze higher in the US met resistance at the wall of moving averages and overbought conditions. The bloodbath in bonds is also having an impact on nervous investors. The short end soared in yield and is in touching distance of the yield curve inverting, a significant indicator that recessionary pressures are rising.

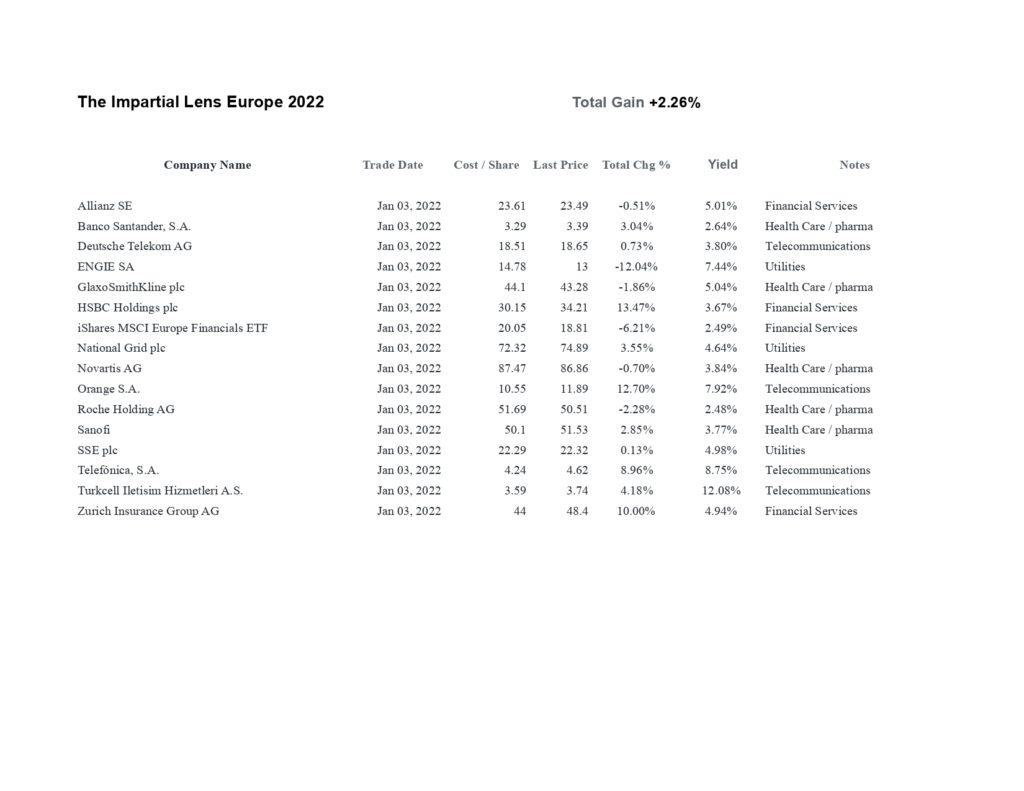

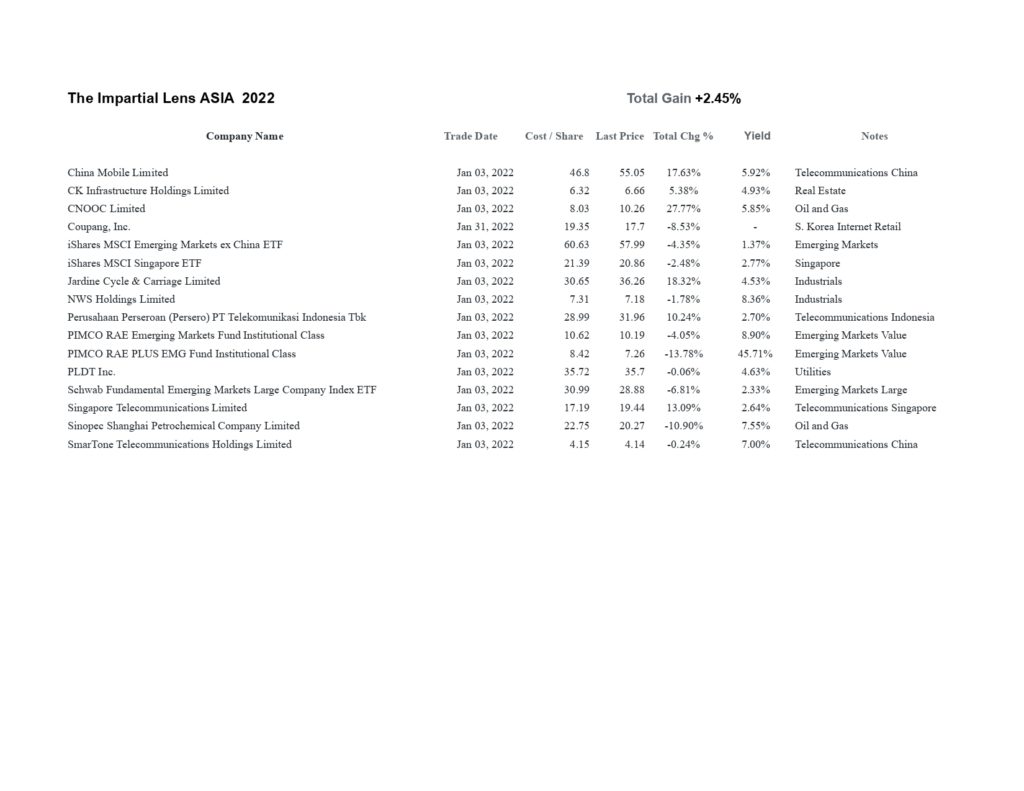

While US markets danced along to their tune, Europe and Asia were mixed. The UK and Japan continued their equity rallies, while Germany, France, China, and Hong Kong finished lower.

Cryptocurrencies screamed higher for a second week in a row, Monero being the exceptional standout.

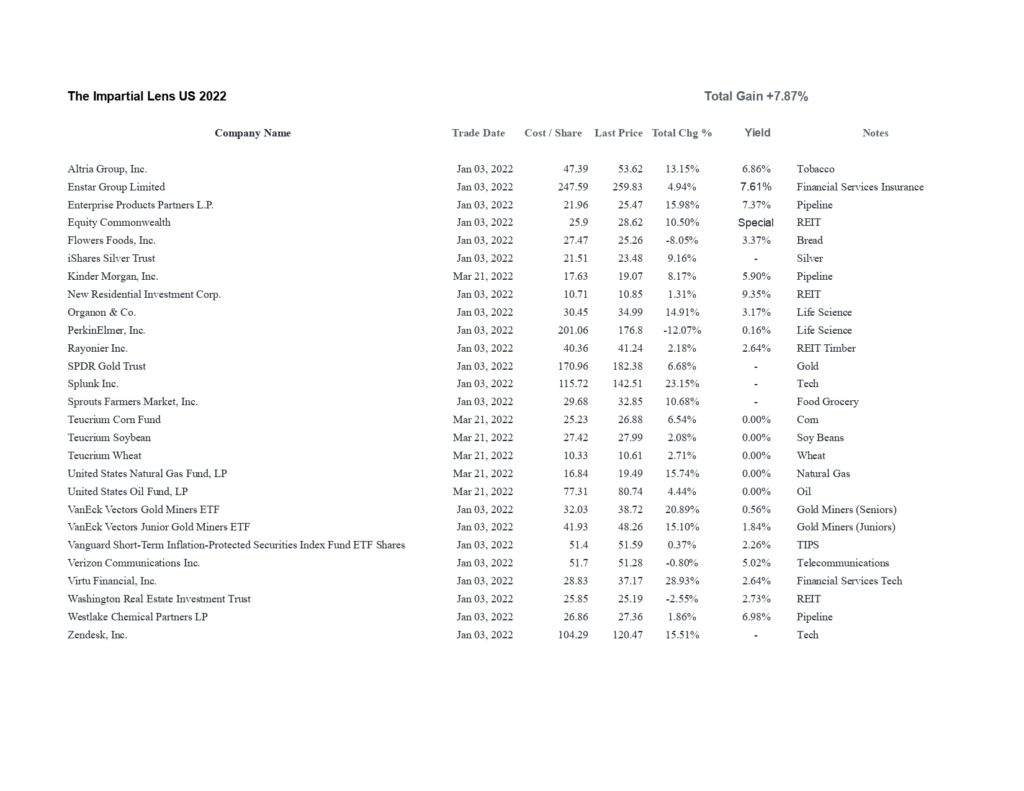

We have pointed out over the last several weeks that we were expecting the rally in equities and a pullback in commodities. While we have enjoyed the rally in equities in our model portfolios, we have also added more exposure to the commodities sector. We added Corn, Wheat, Soy Beans, Oil, Natural Gas, and a Pipeline.

As we start a new trading week, we will tighten up our stops, look to add shorts and be contrarian on bonds. We don’t have all our eggs in the one basket.

Global Markets

Model Portfolio

The information contained here is for educational purposes only. Do not use this information as personal financial advice.