The 15th Week of Trading 2022.

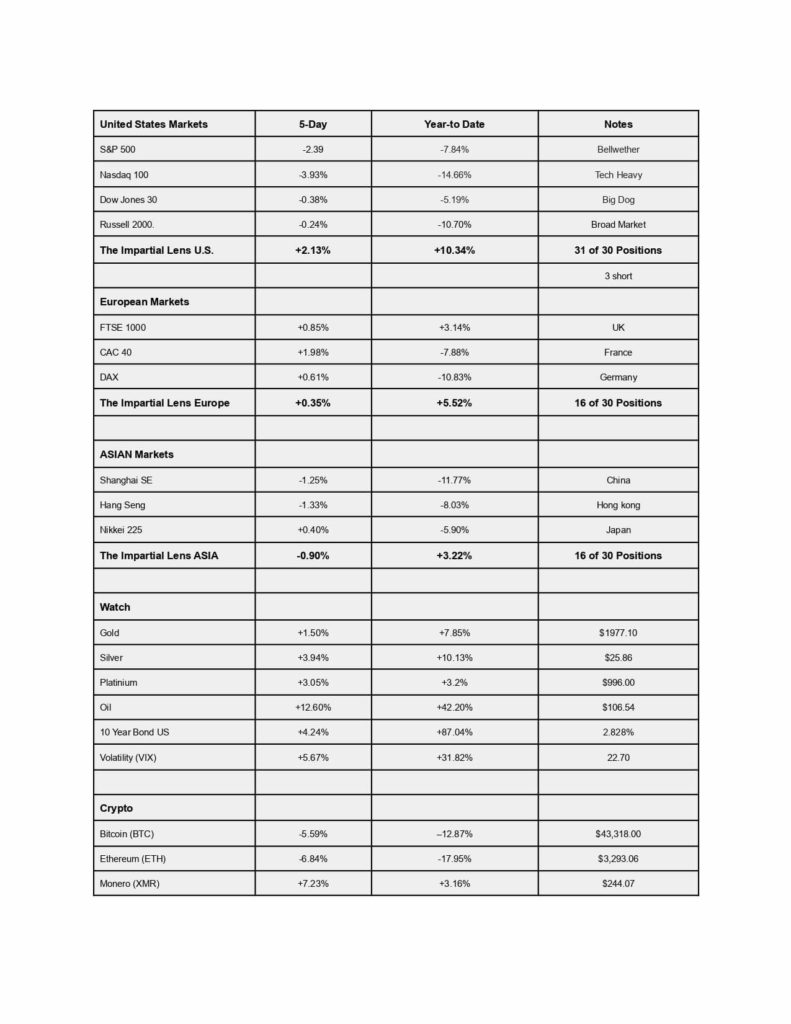

The shortened week of trading started badly for US markets and ended badly. All US indices were down on the week, the tech-heavy Nasdaq suffering the most, down almost -4%.

The European markets performed well last week, with the UK’s FTSE 100 up +0.85%, French CAC 40 up +1.98%, followed by the German DAC up +0.61%.

Asian markets continued last week’s slide, with Shanghai and Hong Kong each down by more than 1% for the week. The Japanese Nikkei was the only saving grace, with a measly +0.40%.

Bitcoin and Ethereum both got beat down again over the course of the week, -6.19% and -4.38%, respectively. In contrast, Monero had another impressive week of +7.23%, up +60% from its January lows.

There was carnage everywhere in the bond market, with the 10-year yield at 2.83%, up a stunning +87% since the beginning of the year.

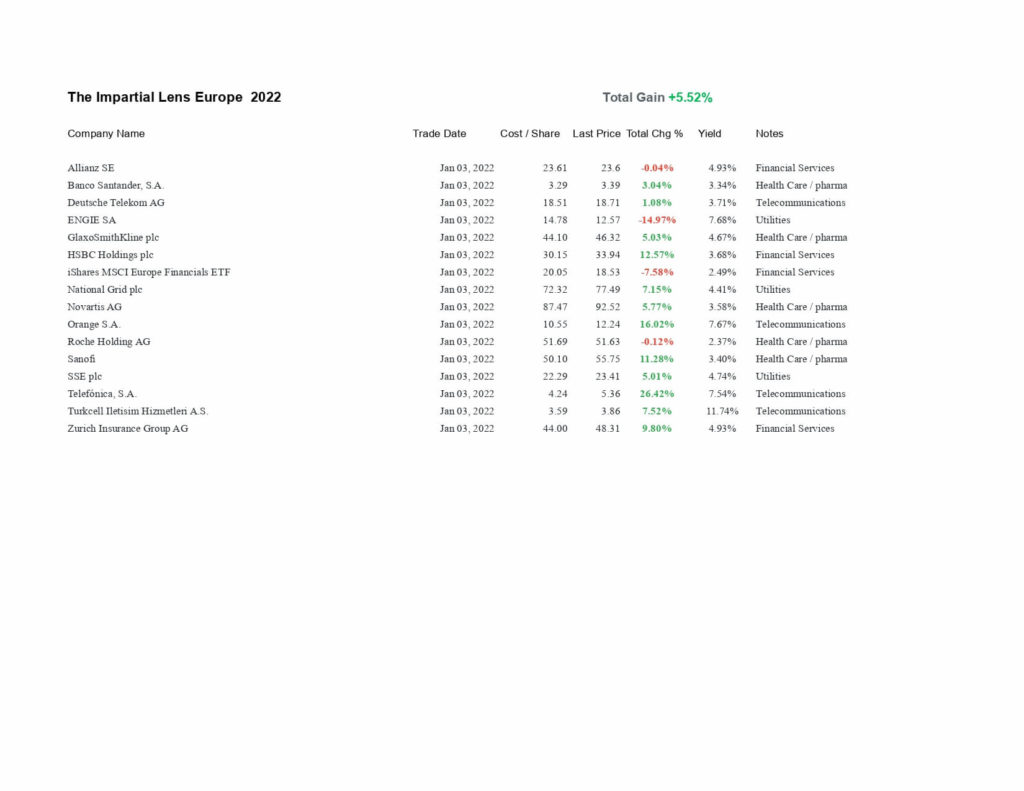

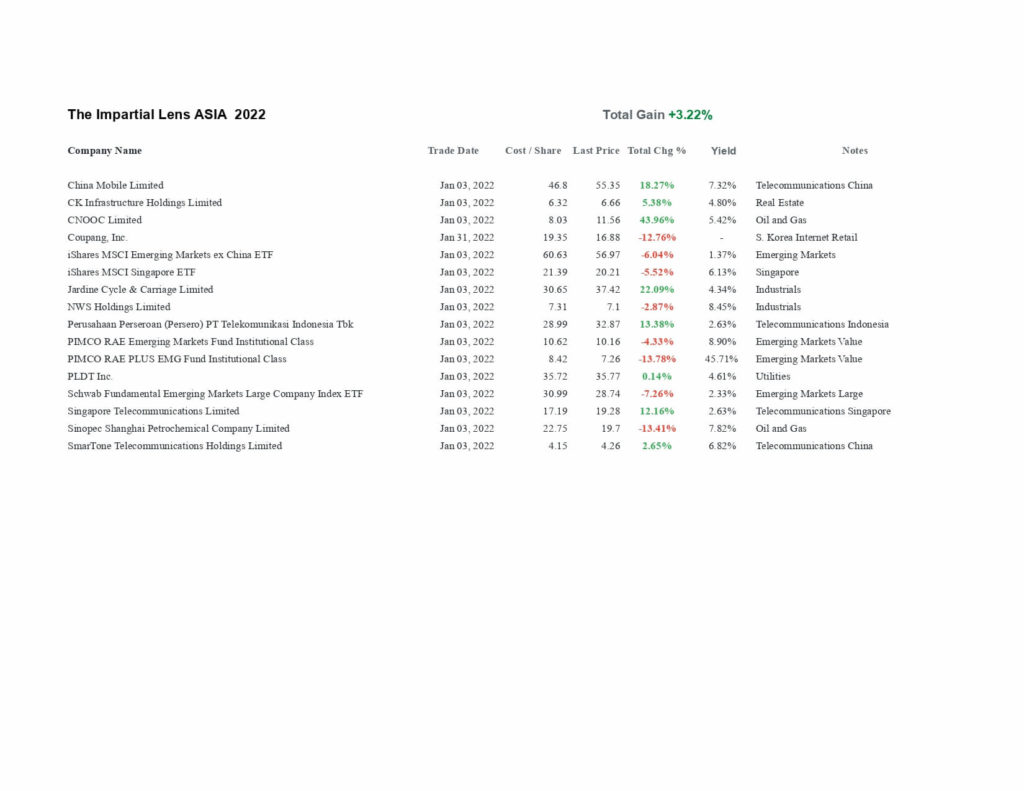

The Impartial Lens model portfolios were mixed, US +2.13%, Europe +0.35%, and Asia -0.90%. As we mentioned last week we added short positions on the Nasdaq (+21.27%), S&P 500 (+10.14%), and Small Caps (+8.8%). It is leverage and we are aware of the risk, we will stop out immediately if we must. However. the pressure on the markets is to the downside. There is not enough fear in the market.

We mentioned last week that we were looking at forgotten markets. South American assets are cheap and offer quite attractive dividends.

Global Markets

Model Portfolio

The information contained here is for educational purposes only. Do not use this information as personal financial advice.