The 16th Week of Trading 2022.

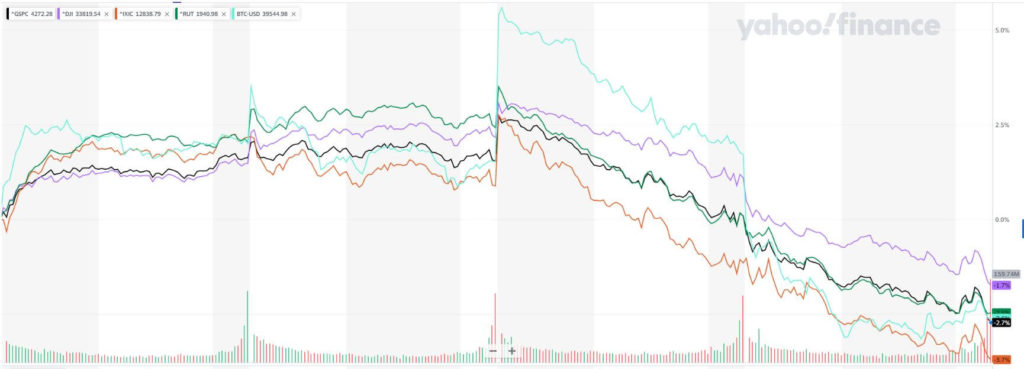

The 16th week of trading started off optimistically for market participants. At the same time, we at the impartial lens were busy furling the sails, battening down the hatches, and tightening up our stops. It was all plain sailing for the markets into mid-morning on Thursday, all indices moving higher in tandem. The bellwether S&P 500 was up almost 3%, and then reality struck, and all indexes nosedived, finishing the week badly damaged.

Last week, we mentioned that “the pressure on the markets is to the downside. There is not enough fear in the market.” The “VIX” fear index exploded higher on Thursday morning, and the selling accelerated into Friday’s close.

The bond market continued the sell-off in the US 10-Year (the most important number in the world), as the yield moved closer to the Rubicon of 3%. Meanwhile, the people trapped inside the vacuum of the Federal Reserve are debating on increasing rates by 0.25-0.50 while inflation is screaming higher. Bizarre…

The Impartial Lens portfolios got a little battered and bruised. However, we had expected it and had prepared accordingly, holding our shorts and staying disciplined. We got stopped out of PerkinElmer, Inc. We will take profits when they are there, cut losses when necessary, and bank our dividends.

Most cryptocurrencies followed the world stock markets lower, all except Monero. Moreno was up 15% for the week, 84% from the January lows. https://theimpartiallens.com/the-weekly-lens-crypto/

We are investigating South America and it’s getting cheaper and gaining value. But not yet…we don’t believe we are out of the storm. We are about to sail around the the horn.

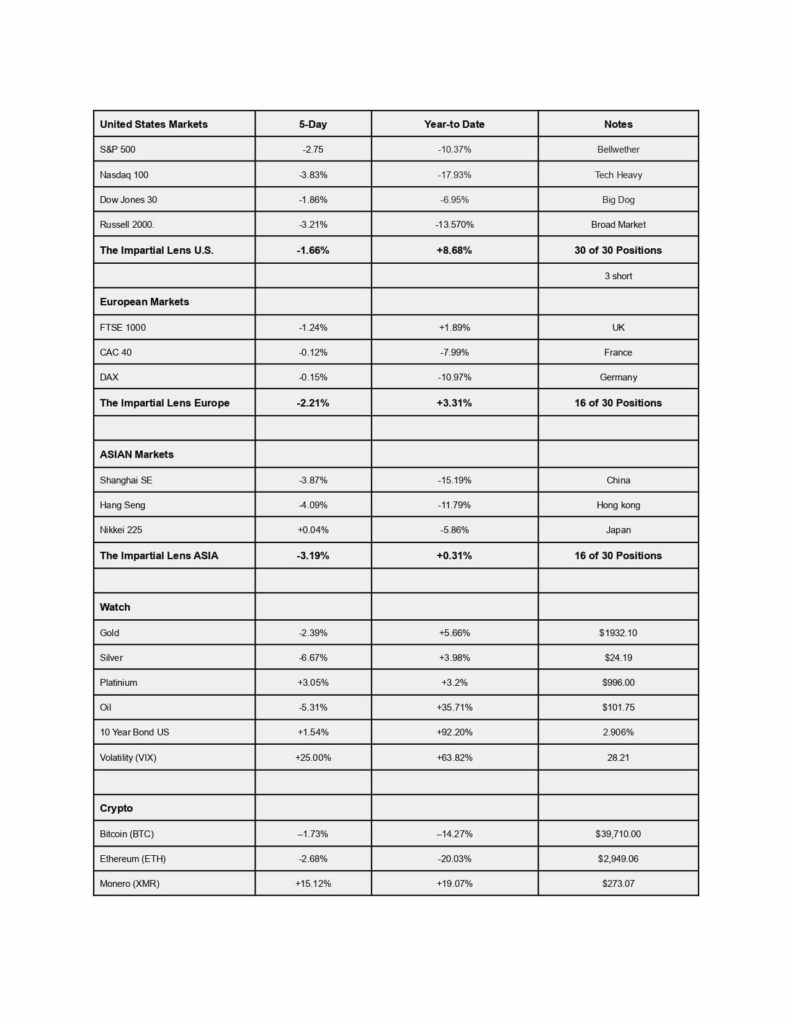

Global Markets

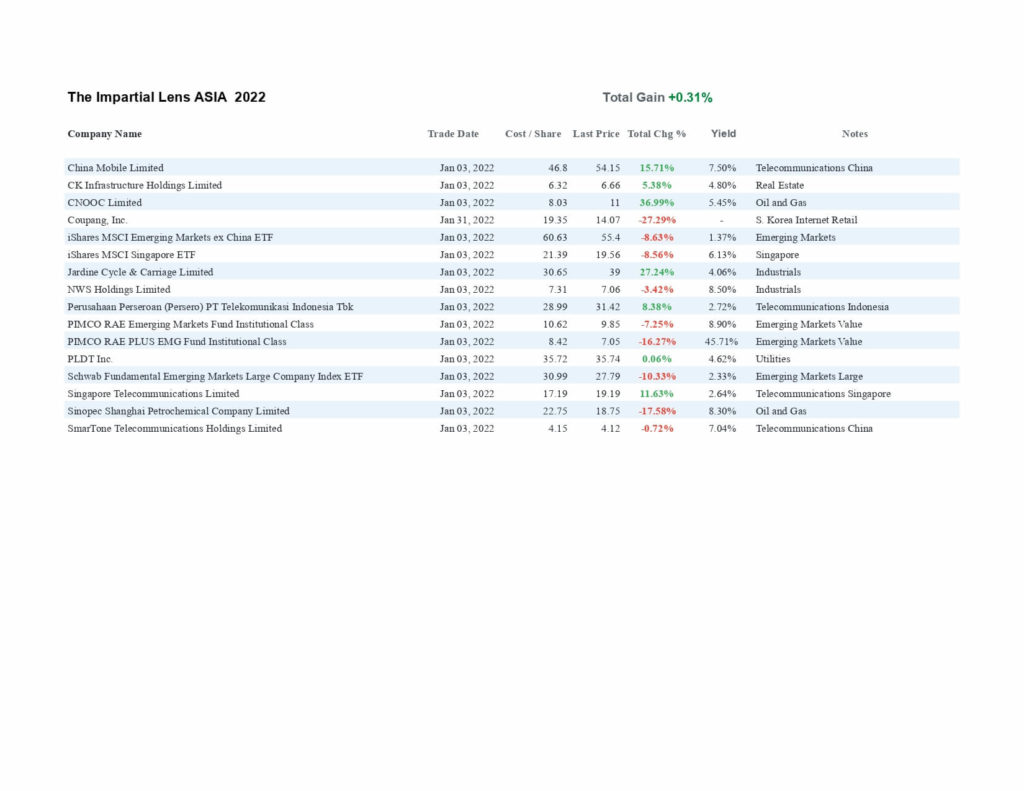

Model Portfolio

The information contained here is for educational purposes only. Do not use this information as personal financial advice.