First Week of Trading 2022

We are one week into the new trading year of 2022. The game is heating up for investors as the tailwinds of 2020-2021 begin to turn into headwinds in 2022. The noise coming from central banks, in particular, the US Federal Reserve about tapering QE and raising interest rates, the lifeblood of rising markets, has investors nervous and confused.

It is undeniable that the fed’s aggressive activity of unprecedented QE bond-buying and suppression of interest rates has supported markets in the last few years.

However, with yields rising on the short end (2-year, 3- year, 5-year, and the 10-year), and yield coming down on the long end (30-year), we have a flattening of the yield curve, a bonafide recessionary signal.

United States & North American Markets

The S&P 500 index, the bell-weather of US investing, has taken a bath in the first week of trading in the US. The overall index is down -2.3%, while 39 components are down -10% or more, and 125 components are down at least -5% or more.

The tech-heavy Nasdaq is down -4.9%, while the broad market index of the Russell 2000 is down -4.20% for the week. The powerhouse industrials of the Dow Jones is down -1.62% overall as investors look for an element of safety amongst the confusion.

European Markets

European markets finished mixed for the first week of trading of 2022. The UK’s FTSE 100 beat the pack with a gain of +1.36% for the week. The French CAC finished as a close second with a modest gain of +0.93%. While the German DAX stumbled across the finishing line with a gain of +0.40%.

Asia Markets

Asian markets were a mixed bag, with Hong Kong’s Hang Seng index finishing the week with a lowly gain of +0.41%. Japan’s Nikkei 225 Index started off the week on a positive note rising through Wednesday only to fade as the weekend approached, finishing with a loss of -1.09% for the week. China’s Shanghai Composite Index struggled to get out of the gate and declined all the way into Friday’s close down -1.65% for the week

The Impartial Lens Model Portfolios.

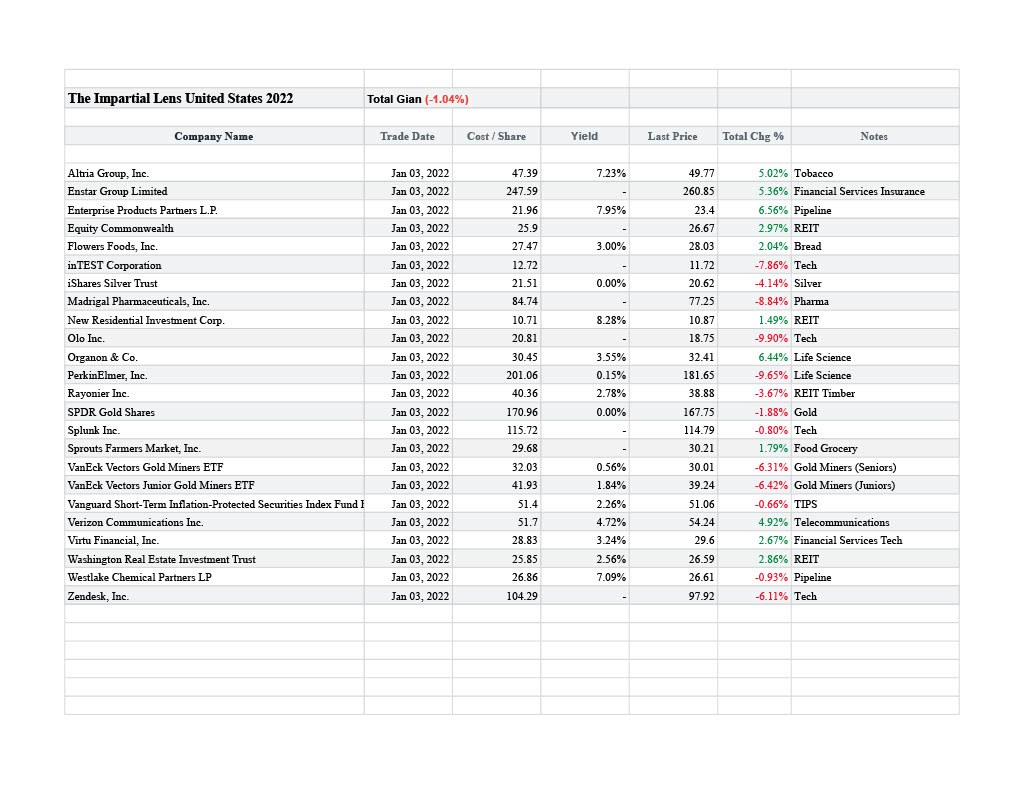

The Impartial model portfolios faired slightly better than the world indexes. Our United States portfolio was dragged down with the sell-off in tech. Our Gold miner stock also sold off with the sell-off in Gold. We are down -1.04%.

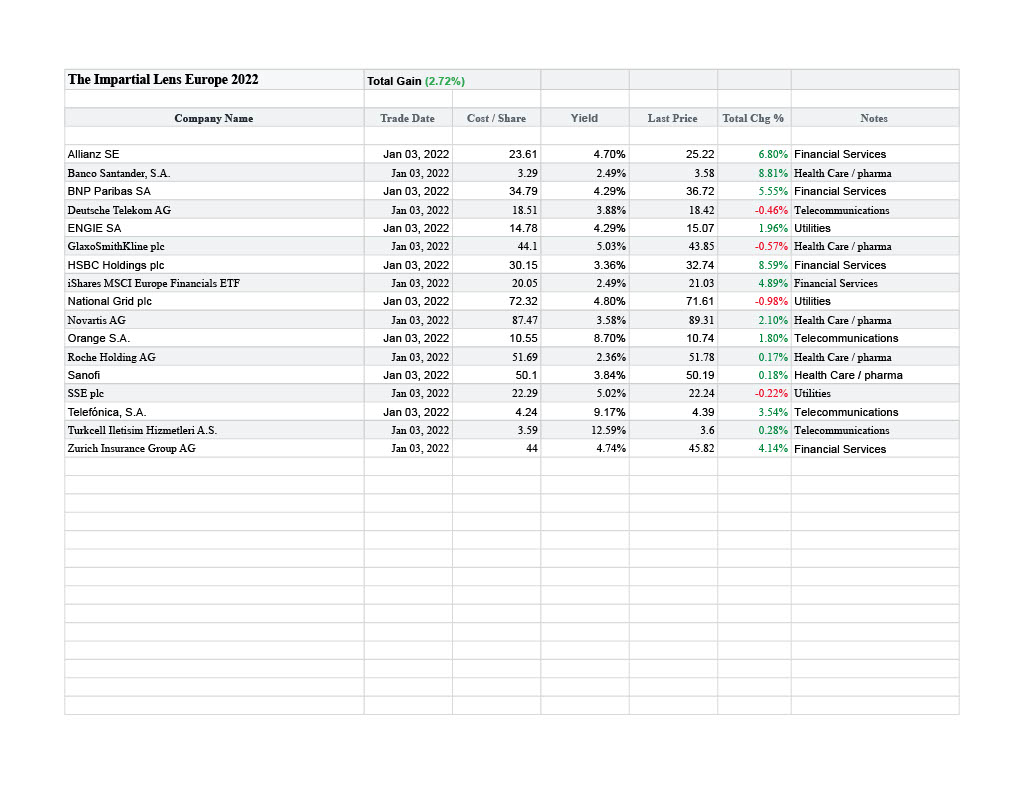

Our European exposer faired much better than European indexes. Our safety and high dividend plays attracting investor money. Our European exposure finished with a gain of +2.72%.

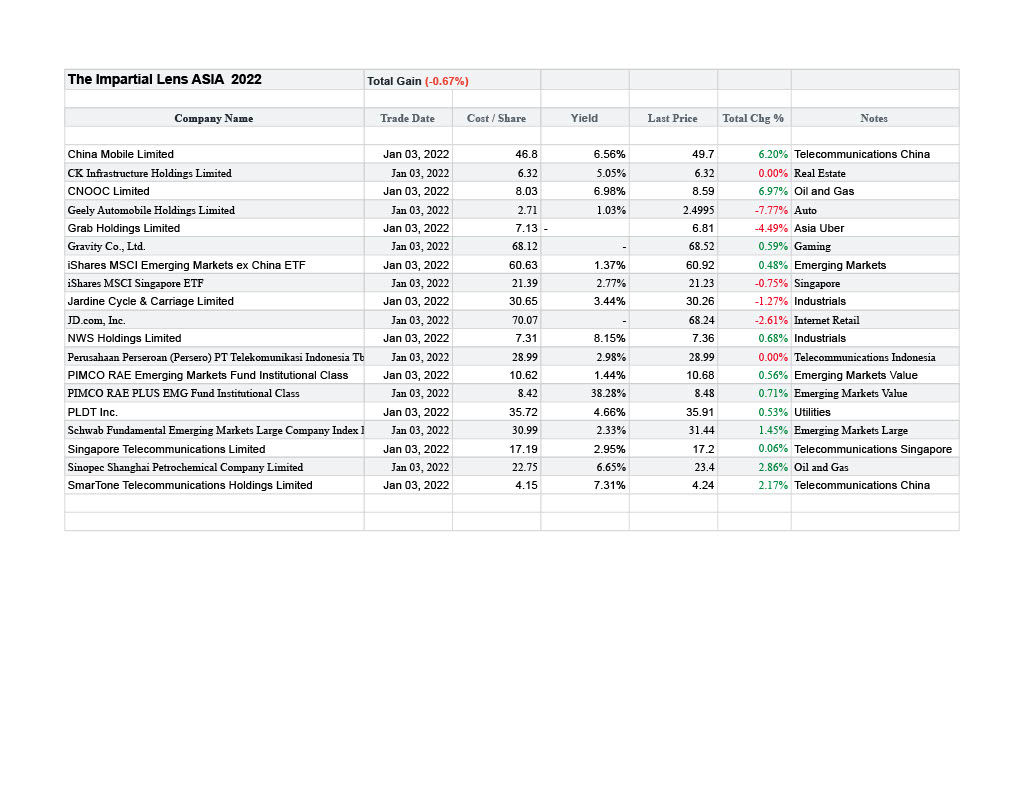

Our exposure to Asia faired slightly better than the Asian indexes, but still finished with a negative -0.67% for the week. See Below.

Sign up for our free newsletter and receive updates directly to your inbox.