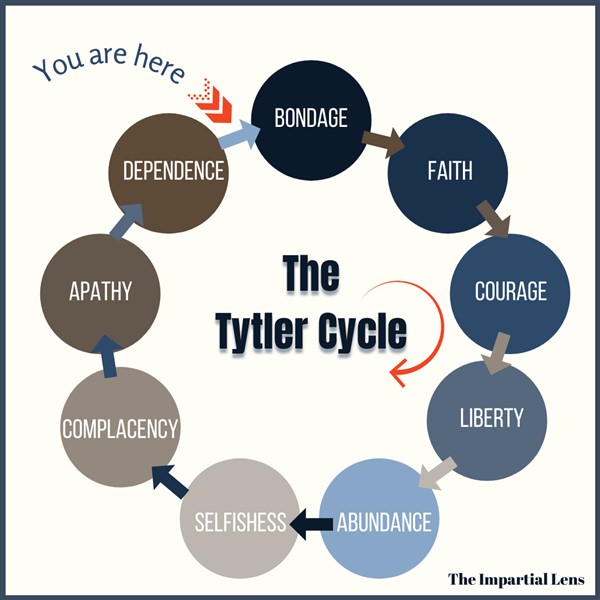

“A democracy cannot exist as a permanent form of government. It can only exist until the voters discover that they can vote themselves largesse from the public treasury. From that moment on, the majority always votes for the candidates promising the most benefits from the public treasury with the result that a democracy always collapses over loose fiscal policy, always followed by a dictatorship. The average age of the world’s greatest civilizations has been 200 years. These nations have progressed through this sequence: From bondage to spiritual faith; From spiritual faith to great courage; From courage to liberty; From liberty to abundance; From abundance to selfishness; From selfishness to apathy; From apathy to dependence; From dependence back into bondage.”

― Alexander Fraser Tytler

The Tytler Cycle In History

Where Are We Now?

We are transitioning from dependence to bondage. The markets are the same, sandwiched in between dependence (on stimulus) and bondage. Get out, get out wherever you are. The velocity of money has crashed, stimulus is ending, markets are extremely expensive (PE 39). We have a real interest rate at close to -4% which would suggest that PE should be closer to 10.

Tighten up the stops, batton down the hatches, know what you hold and why. Gold, real estate, maybe emerging markets providing there is no war and cryptos if that is where your faith lies.

On 08 January 2020, we said to get out: https://theimpartiallens.com/important-portfolio-update/ before the market nosedived back in March 2020. In October 2018 we said to get out: https://theimpartiallens.com/the-impartial-lens-important-portfolio-update/ and we witnessed a $2 trillion wipe out soon after https://www.cnbc.com/2018/10/31/the-stock-market-lost-more-than-2-trillion-in-october.html

Cassandra: Trojan priestess of Apollo in Greek mythology cursed to utter true prophecies, but never to be believed.

We have that feeling again. “You can increase the monetary base all you want, but if you have no velocity, which is behavioral and physiological, you have no growth.” The Impartial Lens 2013

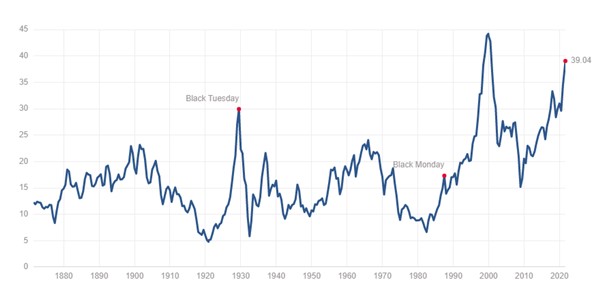

Shiller PE (CAPE) Ratio

The cyclically-adjusted price-to-earnings (CAPE) ratio of a stock market is one of the standard metrics used to evaluate whether a market is overvalued, undervalued, or fairly valued.

https://www.multpl.com/shiller-pe

Inflation-adjusted PE. How expensive are these markets from a historical perspective? Second only to the peak of the madness in the tech bubble of 2020. Expensive…

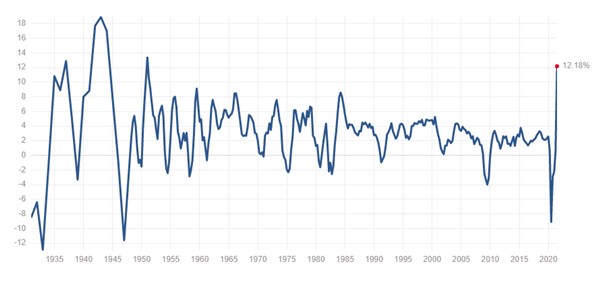

US Real GDP Growth Rate

Inflation-adjusted GDP Growth trending down since the mid-80s. An enormous drop for Covid and the trillions in Stimulus and the “recovery” spike. Trillions…..

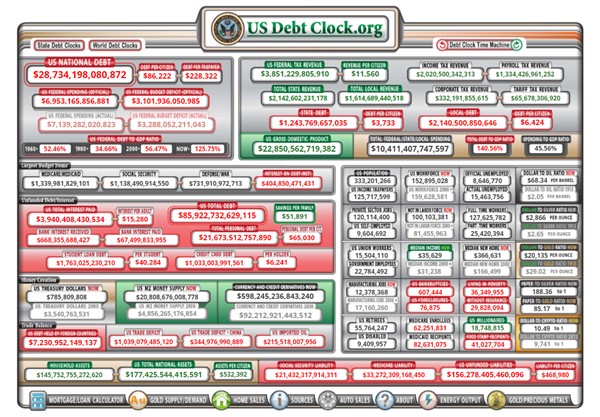

The WTF Chart

https://www.usdebtclock.org/ There are no brakes on this, this is something that is out of control. The only option is to add fuel to the boiler of the runaway train and GO FASTER until it encounters a weak spot on the track. We are rapidly approaching Cassandra’s Crossing.

Final Thoughts

Make sure you have tight stops if you hold stocks, a tight hold if you own gold, magic-wands if you have bonds, tippy-toe with the crypto, and you’re on hash if you hold cash.

Where do you put money in this kind of environment? Drop-in your email and we will send you a little email with a deeper look at what we hold and why we hold it.