Fifth Week of Trading 2022.

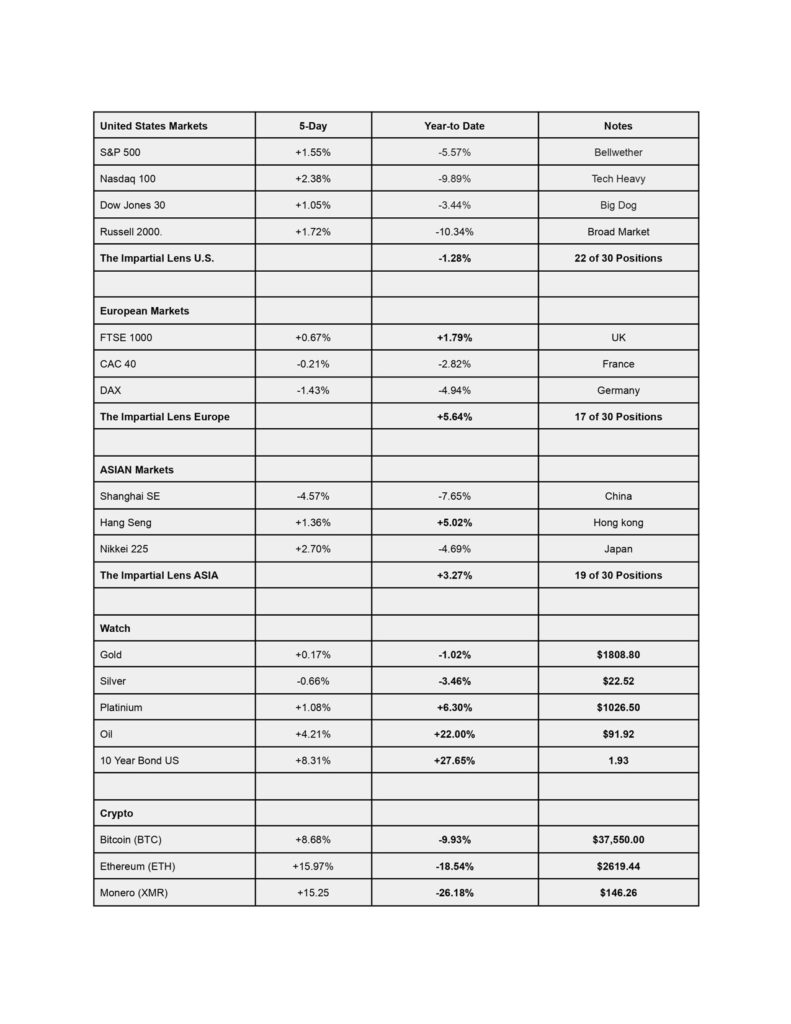

Investors were grateful to leave January trading jitters in the rearview mirror. January was a bad start to the year for investors, and most are happy to see it behind them. US Markets soared into midweek, only to pull back in Thursday’s session, warning participants to be cautious. The US markets slid into the close on Friday, thankful to be positive on the week.

The Bellwether S&P 500 closed out the week with a +1.55% gain, down -5.57% year-to-date. The big dog Down Jones Industrials closed out on a positive +1.05%, down -10.34% YTD, while the broad Russell 2000 was positive +1.72%, down -10.34% YTD. The tech-heavy Nasdaq had a good close to a week, up 2.38%, but down 9.89% TTD.

Cryptocurrencies mimicked the action of the stock market indices at the beginning of the week, only to collapse into midweek, and then resurrected on Friday, with Bitcoin finishing up +8.68% for the week but still down 9.93% YTD.

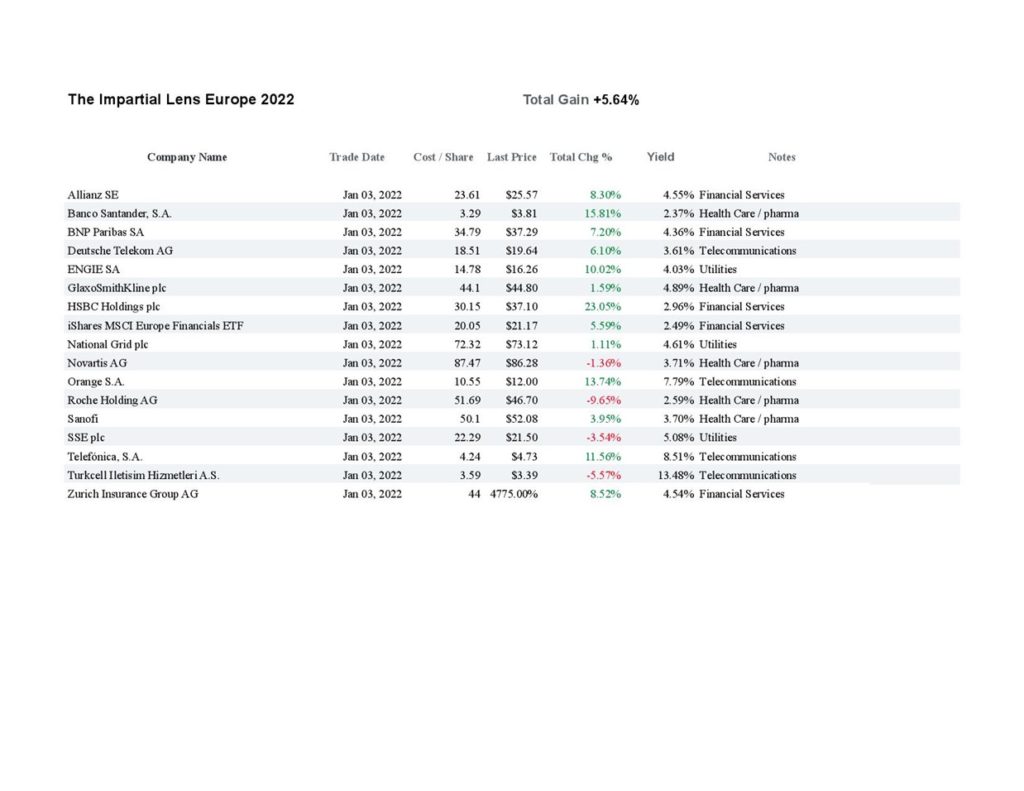

European markets were a mixed bag for the week, with only the UK’s FTSE managing a positive finish, up +0.67%. The French CAC stumbled to the end of trading Friday, down -0.21%, while the German Dax was the laggard for the week, down -1.43%.

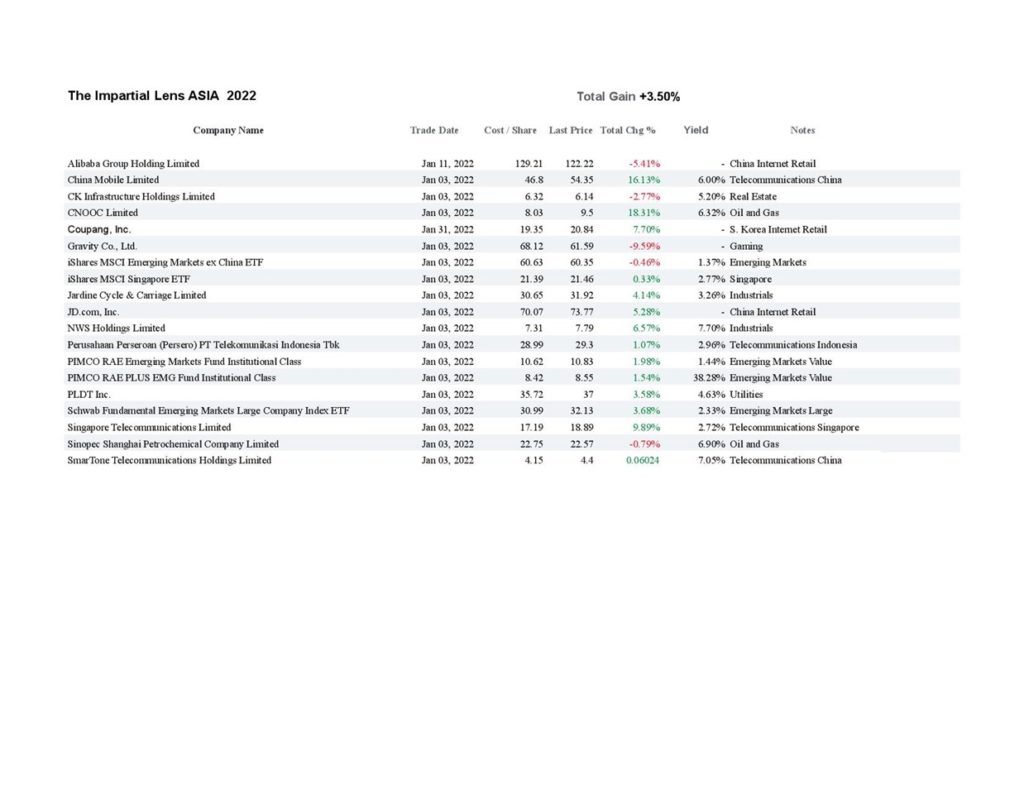

Asian markets finished mixed with China’s Shanghai hammered, down -4.57% for the week. Hong Kong’s held its own for the week, finishing up +1.36%, and Japan’s Nikkei finished with a very positive +2.70% for the week.

The Impartial Lens model portfolios held their own against all market indices. Dividends will begin to trickle in this month. We’ve added a new position to our Asian portfolio.

The Elephant in the room that is coming into focus for investors is geopolitical risk.

Global Markets

Model Portfolios

The information contained here is for educational purposes only. Do not use this information as personal financial advice.