The 17th Week of Trading 2022.

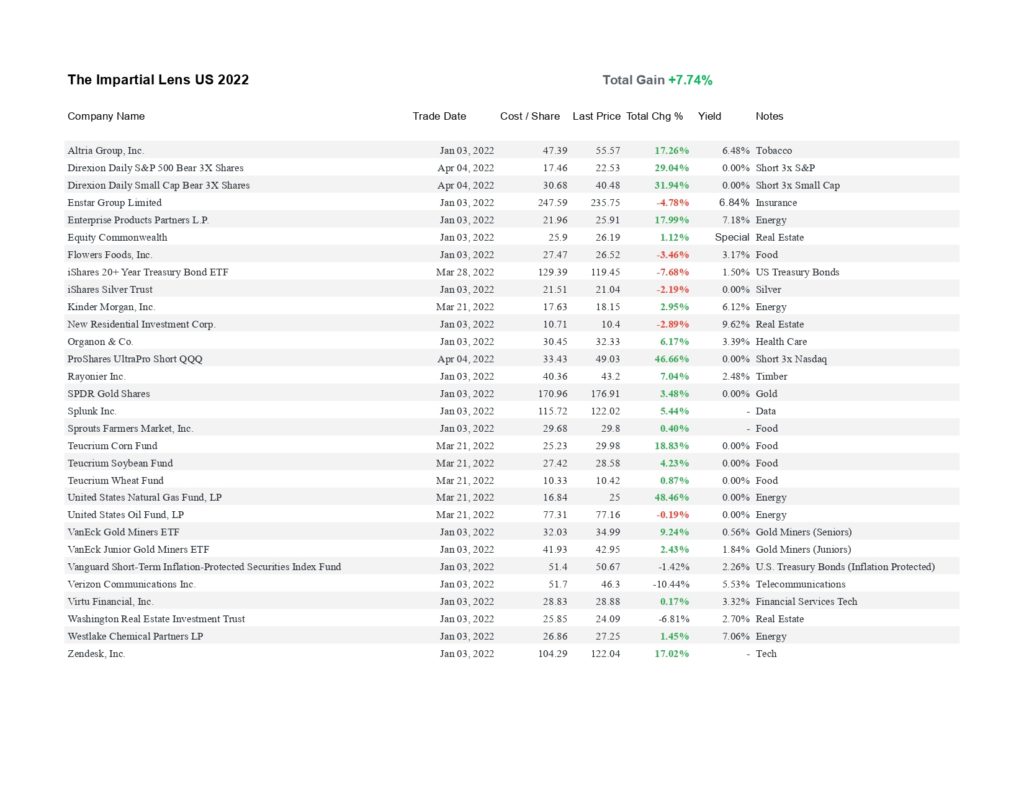

Holding short positions, especially leveraged short positions, is like holding a tiger by the tail. Great fun until you get savaged. We’ve been short with leverage of all the major indices in the United States since April 4th, 2022.

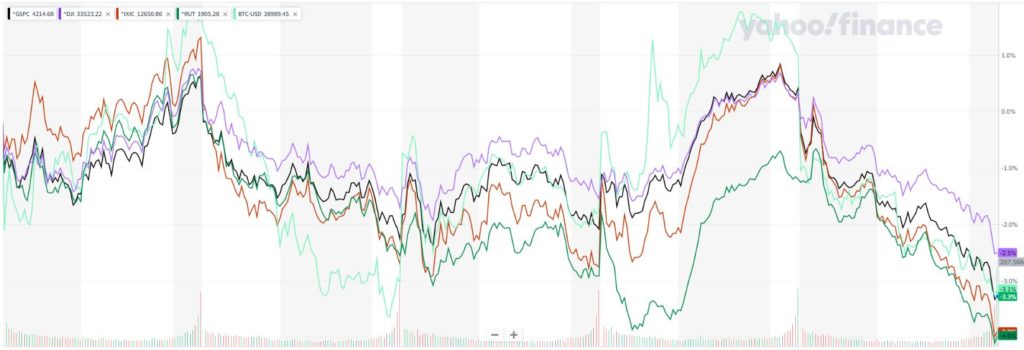

Despite our warning last week to rig for stormy weather, the week started off on a positive note, with the S&P 500 up almost 1% at the close on Monday. Tuesday, the indices collapsed but traded sideways on Wednesday, followed by a significant rally on Thursday. Friday, the storm broke.

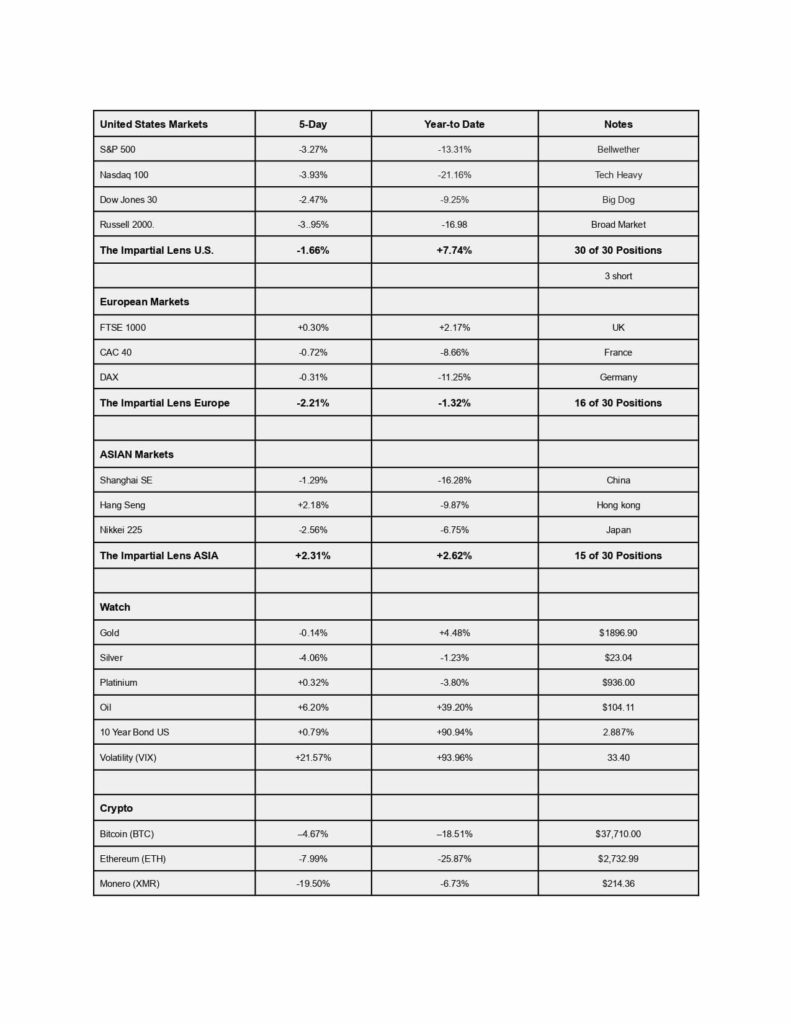

Fear swept the market from the crest of Thursday’s wave of buying, the fear gauge “the Vix” spiked, and selling began. At the end of trading, the S&P alone dumped -3.60%, down -13% for the year. The Nasdaq -21.16%, the Small Caps Russell -16.98%, and the Dow almost -10% since the beginning of the year.

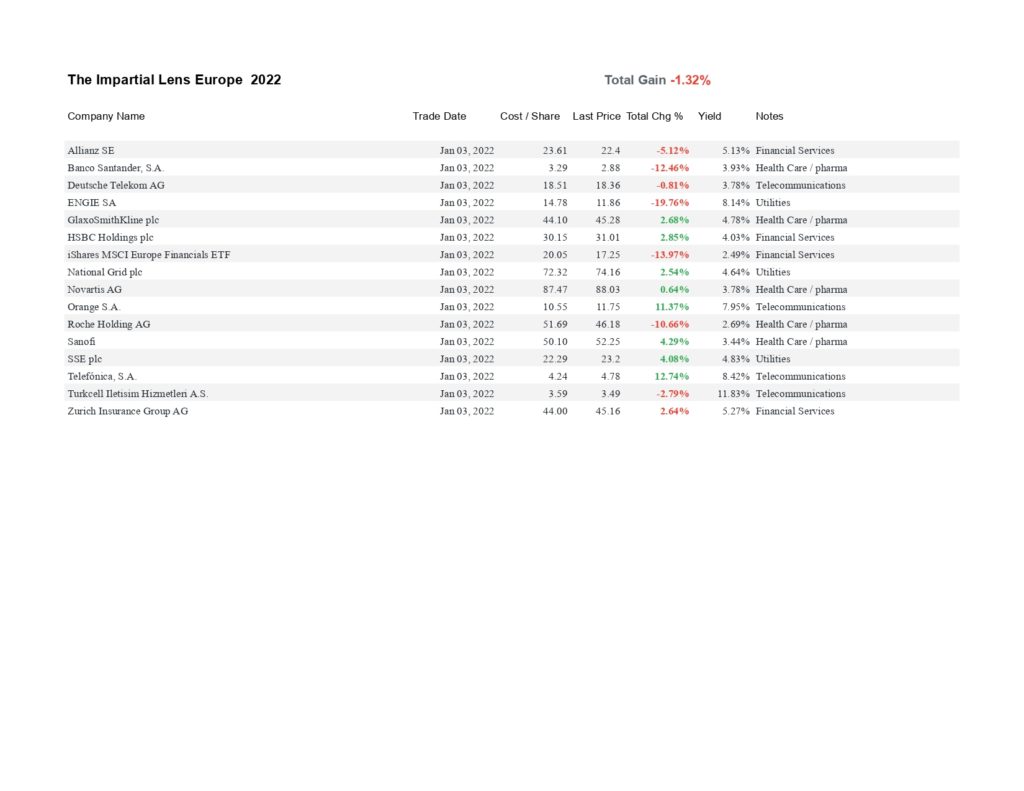

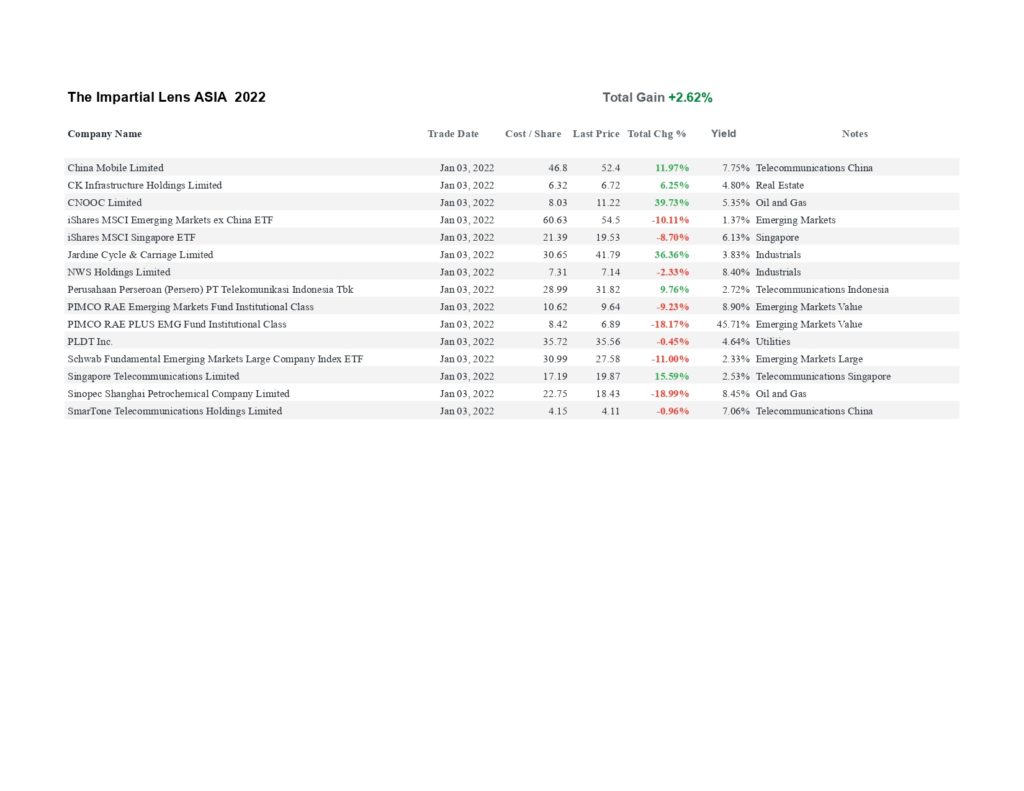

The impartial lens model portfolios were a mixed bag. Our US portfolio got dragged down in Friday selling, but our short positions kept us afloat. Our European and Asian positions did the complete opposite of each other, one down -2.21% and the other up +2.31%. As always we remain disciplined, we stopped out of Coupang, Inc.

We wrote a piece in September 2021 called Cassandra’s Crossing, but it was ”never to be believed.” The article said no US index would make it unscathed to the beginning of 2022. And we were entering a time when the QE had become dependent on was ending. We warned you to tighten up your Stock and Bond market positions.

We wrote a piece back in February 2021, The Devil is In the Details, warning that the US would eventually only have one asset that would be worth anything to bargain with; although an illusion, “the mighty Dollar.” is still perceived to offer ‘full faith and credit.”

The flee back into the US Dollar over the last year is not a sign of strength; it is a sign of the end.

Global Markets

Model Portfolio

The information contained here is for educational purposes only. Do not use this information as personal financial advice.

Photo by Ryunosuke Kikuno on Unsplash